Articles

Financial Inclusion

Apr 15, 2024

In November 2023, the United Nations Development Programme (UNDP) moderated the closed-door roundtable "How Universal Trusted Credentials (UTC) can transform financial inclusion" . This event brought together senior representatives from central banks, financial institutions, and other stakeholders from around the world to discuss the opportunities...

Financial Inclusion

Youth Entrepreneurship

Aug 14, 2023

Over 163 million informal workers in emerging markets have found new opportunities through #gigplatforms, but many remain financially excluded. That's why platforms are stepping up to offer financial services to #gigworkers, helping them save, invest, and access credit. The impact can be positive for the workers and the economy. If you're...

Credit Risk & Scoring

Feb 08, 2023

Our member, Asante Financial Services Group, is driven by passion to see to the growth of the MSME sector in Africa. It is through strategic partnerships such as the one with SOLV Kenya, a member company of Standard Chartered Banking Group, that we are able to extend our reach to the Kenyan MSMEs In Sub-Saharan Africa, micro, small and medium...

Alternative Financing

Digital Financial Services

Dec 15, 2022

Digital lending or alternative lending is a catalyst to inclusive financial services for segments that are not a key target for traditional financial institutions. The use of AI-powered decisioning systems for evaluating individual credit eligibility by digital lending platforms has now become critical for micro, small and medium enterprises (...

Sustainable Finance

Digital Transformation

Oct 05, 2022

What we heard on September 21 st …. We kicked off the second day of the Global SME Finance Forum 2022 with Ruth Horowitz - Regional Vice President for Asia and the Pacific, IFC and his Excellency Phan Phalla - Secretary of State for the Ministry of Economy and Finance of Cambodia. Both Ruth Horowitz and Secretary Phan Phalla spoke about the...

Sustainable Finance

Digital Transformation

Oct 04, 2022

What we heard on September 20 th …. Opening remarks were given by H.E. Chea Chanto – Governor, National Bank of Cambodia and Tomasz Telma – Director, Financial Institutions Group, IFC Chea Chanto laid out examples of how Cambodia is increasingly leveraging digitalisation to improve access to finance and Tomasz Telma talked about data driven...

Trade Finance

Sep 14, 2022

This podcast prepared by our industry partner Trade Finance Global, features Matt Gamser, CEO of the SME Finance Forum and Magda Bianco, co-chair of the Global Partnership for Financial Inclusion (GPFI). It gives an overview of current G20 initiatives designed to help SMEs get easier access to finance. Among those initiatives is the Global SME...

Sustainable Finance

Dec 01, 2021

Conference Proceedings of the 2021 Global SME Finance Forum Day 1 - October 18th Opening Remarks Makhtar Diop, Managing Director and EVP, International Finance Corporation (IFC) We need contribution from SMEs to help us reach our sustainability goals. Individually not a major source of greenhouse gases but collectively account for a significant...

Guarantees

Covid-19

May 27, 2021

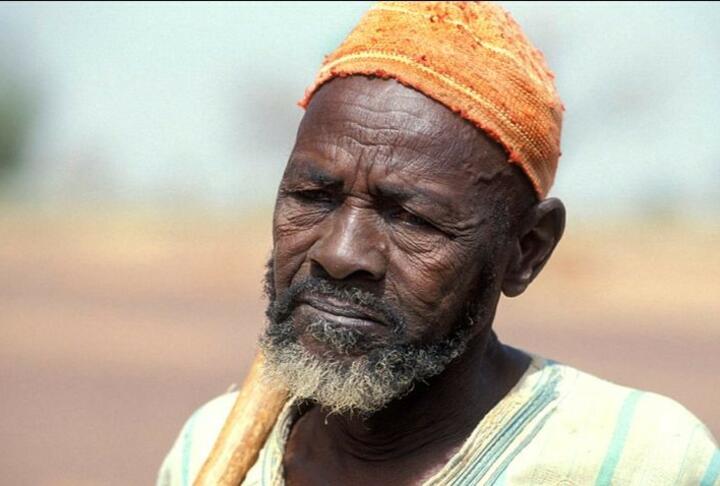

Posted originally in the Financial Resilience Around the World, World Bank Blog Series Burkina Faso, a landlocked country in the heart of the Sahel region, was already facing difficult challenges when the COVID-19 outbreak occurred. The security context had been deteriorating since June 2018, with an upsurge in violent attacks by terrorists and...

Digital Transformation

Mar 15, 2021

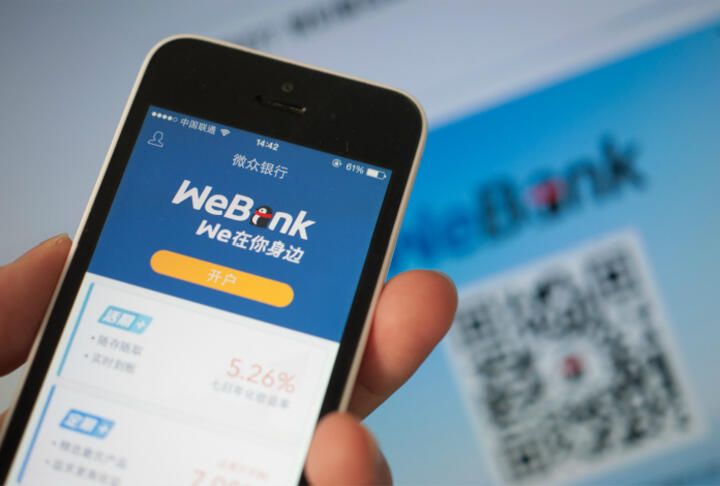

*This article is an excerpt with key highlights from WeBank’s recent presentation at the 2021 Knowledge Annual Conference of the IFC. The pandemic has shoved the global economy into a state of chaos, affecting both large corporations and SMEs across nearly all sectors. However, the global outbreak has also brought opportunities to innovate...