Library

Digital Transformation

Apr 18, 2024

Washington D.C, April 18th, 2024 – Singapore-based fintech Boost Capital has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge...

Apr 18, 2024

Washington D.C, April 18, 2024 - Singapore-based fintech Digi Ally has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange...

Digital Financial Services

Apr 15, 2024

Financial makers discuss how to reimagine banking with embedded finance solutions that deliver financial services whenever and wherever they’re needed. A new generation of financial thinkers and makers is reimagining the conventional bank. Empowered by technology and a youthful hunger for change, they’re determined to make banking easier, more...

Governance

Data & Cybersecurity

Apr 15, 2024

The game-changer: How generative AI can transform the banking and financial sectors The most essential question of the moment: how can AI help address and course-correct banks’ productivity and financial performance? Following the astonishing rise of generative AI, artificial intelligence has seized the world’s attention. Executives are either...

Digital Transformation

Apr 15, 2024

Access to affordable finance poses a persistent challenge for micro, small, and medium-sized enterprises (MSMEs) worldwide, inhibiting their potential growth and the economic development of countries that are reliant on these businesses. The rise of the digital economy has opened up new pathways for financing, but has also made digital...

Fintech

Payments

Apr 15, 2024

Summary: - Regional focus: the report foretells a surge in interest from fintechs towards SMEs in Latin America by 2024. - Innovation opportunities: it highlights the potential for innovation within the industry and identifies key areas where solutions can reshape the fintech landscape to better serve SMEs. - Targeted countries: discover which...

Financial Inclusion

Apr 15, 2024

In November 2023, the United Nations Development Programme (UNDP) moderated the closed-door roundtable "How Universal Trusted Credentials (UTC) can transform financial inclusion" . This event brought together senior representatives from central banks, financial institutions, and other stakeholders from around the world to discuss the opportunities...

Digital Financial Services

Fintech

Apr 15, 2024

The launch event for isybank, Intesa Sanpaolo's digital bank, was held on 15 June at the "Shard of Glass" tower in Milan. The bank is primarily intended to serve the four million Intesa Sanpaolo customers interested in using innovative services exclusively online and on their smartphones. isybank is among the most important initiatives in the 2022...

Equity

Apr 15, 2024

Intesa Sanpaolo acquires Romania’s First Bank from US-based private investment fund J.C. Flowers & Co., strengthening its presence in the CEE region and doubling the Group’s presence in the country. More in detail , Intesa Sanpaolo and JCF Tiger Holdings S.A.R.L., the controlling shareholder of First Bank S.A., have signed a share purchase...

Sustainable Finance

Apr 15, 2024

Under the guidance of Niti Aayog, government primer think thank, and RMI as a knowledge partner, Small Industries Development Bank of India (SIDBI) has developed a book titled “De-risking lending for a Brisk EV Uptake: A practical guide on de-risking measures for Electric two- and three-wheelers in India" The report was released in Washington DC...

Financial Inclusion

Sustainable Finance

Digital Transformation

Apr 15, 2024

Karandaaz Pakistan, a development finance platform at the forefront of promoting financial inclusion and driving digital transformation across the country, announced the launch of GreenFin Innovations (GFI), a groundbreaking initiative dedicated to scaling innovative and sustainable solutions aimed at promoting a green economy and addressing the...

Digital Financial Services

Fintech

Payments

Apr 15, 2024

Bespoke tech solutions providers team up to empower digital transactions of small- and medium-sized business enterprises across MENA with cloud-based software Riyadh, Saudi Arabia, September 5th, 2023 – TRAY, a global leader in cloud-native enterprise-class POS systems, is pleased to announce a strategic partnership with Alraedah Digital Solutions...

Gender Finance

Fintech

Mar 21, 2024

Fintech and digital financial services have been considered a game-changer for women's financial inclusion and economic empowerment. Until now, there has been limited research that quantifies the degree to which fintech firms are actively addressing women's financial inclusion and the specific strategies that are showing success. To fill this gap...

Financial Education

Financial Inclusion

Alternative Financing

Gender Finance

Youth Entrepreneurship

Mar 08, 2024

The Forum established the Women’s Entrepreneurship Finance CoP (WEF CoP) Practice for groups of practitioners from member institutions to meet and share experiences, seek solutions to challenges that they face in financing women-SMEs. Since launching in 2022, the WEF CoP has evolved into a powerful example of how to empower women entrepreneurs...

Alternative Financing

Digital Transformation

Fintech

Feb 28, 2024

Johannesburg, 6 February 2024 – MTN’s Mobile Money Platform, MoMo, and banking technology company JUMO have partnered to launch Qwikloan, which offers affordable, short-term loans in South Africa and will drive financial inclusion across the country. Qwikloan enables MoMo users to obtain small, short-term loans on their mobile phones, ranging from...

Financial Education

Financial Inclusion

Fintech

Feb 14, 2024

This paper investigates strategies of European microfinance institutions (MFIs) and inclusive FinTech organisations to address financial and digital illiteracy among vulnerable customers. It reveals that both MFIs and FinTech organisations focus on personalised financial education, training and coaching but adopt distinct strategies in their...

Sustainable Finance

Fintech

Feb 12, 2024

Slowing economic growth, rising inflation, and climbing interest rates are straining the business models for inclusive fintechs, creating significant uncertainty and new funding challenges. For the past four years, the Inclusive Fintech 50 (IF50) global innovation competition identified and elevated cutting-edge, emerging inclusive fintechs...

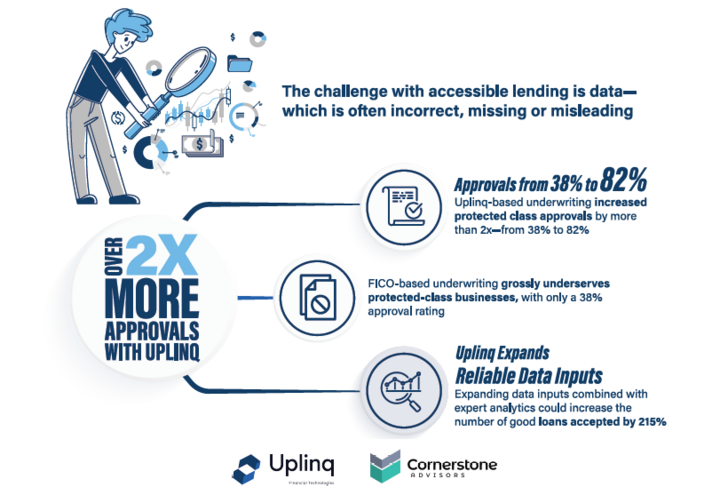

Alternative Financing

Feb 02, 2024

Uplinq Financial Technologies , the first global credit decisioning support platform for small business lenders, announced the publication of “ Fair and Accessible Credit for Small Businesses: A Guidebook for Financial Institutions ,” a white paper that blueprints how banks and credit unions can leverage AI technology and alternative data to...

Financial Inclusion

Jan 31, 2024

Washington D.C, January 31, 2024 – Nigeria’s Zenith Bank has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and...

Jan 31, 2024

The SME Finance Forum membership network consists of more than 240 member institutions active in 190 countries . The network is a unique community of SME-oriented commercial banks, non-bank financial institutions, fintech companies, and development finance institutions. UPCOMING EVENTS - Q1 and Q2 2024

Digital Transformation

Jan 23, 2024

With the rapid advancements in computational power, the decades-long vision of using and deploying artificial intelligence (AI) has become a reality. The technology’s swift development has allowed it to transform every walk of life, as it is a wide-ranging tool that enables people to rethink how to analyze data, integrate information and use the...

Financial Inclusion

Jan 18, 2024

Washington D.C, January 18, 2024 – AccèsBanque Madagascar has joined the SME Finance Forum as the global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge exchange and...

Sustainable Finance

Digital Transformation

Dec 22, 2023

Learn from Michael Jongeneel, about ESG data aggregation practices within FMO and digitalization benefits for SMEs. Interview led by Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. ‘I have been in Mumbai for less than 24 hours, but I already had a couple of very interesting discussions and potential collaboration with Indian...

Digital Financial Services

Payments

Dec 22, 2023

Learn from Jane Prokop - EVP of Small and Medium Enterprises at Mastercard, about her experience attending the Global SME Finance Forum for the first time and the latest challenges of digitalization. Interview led by Hans Koning, Global Chief Industry Specialist, Digital Finance at IFC. ‘It is my first time joining the SME Finance Forum and it has...

Financial Inclusion

Dec 22, 2023

The Inclusive Finance India Report provides a comprehensive review of the progress of financial inclusion in the country, tracking performance, highlighting achievements, and flagging gaps and issues that need to be addressed at the levels of both policy and practice. It is a much-awaited annual reference document for policymakers, investors,...

Payments

Dec 21, 2023

Former SVP and Managing Director of Marqeta takes on new role at leading global issuer-processor to propel its growth journey across the globe 12 th Dec Paymentology , a leading global issuer-processor, today announces the appointment of its new CEO Jeff Parker, who will be succeeding the interim Co-CEOs Abe Smith and Angy Watson. Jeff is a leader...

Islamic Banking

Dec 18, 2023

In the latest episode of Couchonomics, Arjun was joined by Paul Melotto, Executive Board Member at Alraedah Finance . Paul has played a key part in Arjun’s journey to understand the Saudi ecosystem, especially regarding fintech and financial services. In the episode, Arjun and Paul discussed: The state of Non-Banked Financial Institutions in KSA...

Credit Risk & Scoring

Dec 13, 2023

Former CEO of TransUnion Europe – Satrajit Saha – brings his expertise to Creditinfo, planning to drive growth across its credit bureaus globally. London – 29 th November 2023: Creditinfo, a global service provider for credit information and risk management solutions, has today announced the appointment of Satrajit Saha as its Global Chief...

Financial Inclusion

Non Financial Services

Rural & Agriculture Finance

Dec 06, 2023

Washington D.C, December 6, 2023 – Leading agri-services company SE Holdings has joined the SME Finance Forum as its global membership network’s latest member. The 240+ members of the Forum are SME financing experts operating in 190 countries who share the common goal of expanding access to finance to small businesses worldwide through knowledge...

Non Financial Services

Equity

Dec 05, 2023

Learn from PVSLN, Murty, Chairman and Managing Director, North Eastern Development Finance Corporation (NEDFi), about their mission to champion the entrepreneurial spirit of the North Eastern Region of India, financing commercially viable industries and providing consultancy services. The interview is led by Hans Koning, Global Chief Industry...