Blog

SME Finance Forum Co-Organizes High-Level Roundtable on Accelerating SME Finance in Italy

The SME Finance Forum held a jointly organized high-level roundtable with the Global Agenda Council of the World Economic Forum on the Future of Financing and Capital (GAC) and the Association of Banks in Italy (ABI) on June 30 in Milan. The focus was on accelerating SME finance in Italy, drawing on successful examples from other markets. Panels covered a variety of topics, including

- an overview of how Fintech lenders and vendors are helping to reshape the financial services industry,

- alternative data and new technologies that are transforming credit decisioning, broadening access, lowering costs and quickening delivery,

- credit referrals programs, how some have worked in the past and the UK’s new mandatory schemes will operate going forward,

- partnerships between Fintechs and traditional lenders that are helping both to succeed in improving efficiency, lowering costs and expanding capacity to meet demands for funding and

- key elements of the legal and regulatory frameworks needed to enable ongoing innovation both by Fintech and traditional financial institutions and the partnerships that seem key

to success accelerating SME financing.

Over 80 senior representatives from the banking sector, alternative finance, government and regulatory bodies from Italy and the European Union participated in the Roundtable, along with a few experts drawing on experiences from other regions.

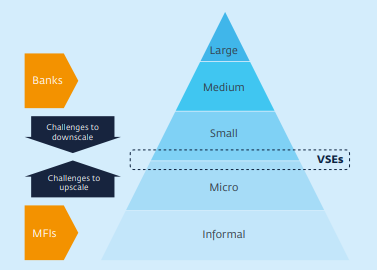

Challenges facing banks give openings to new entrants using more data, new technology

Key takeaways included broad consensus on the difficulty banks now face serving SMEs, not just in the Italy and Europe but globally as well, given limited risk appetite, increases in capital requirements and compliance costs and the need to change business models that are often not profitable. Fintechs able to apply new technologies and processes to rapidly expanding volumes of transactions and other data have the potential to enable lenders to reengineer and optimize credit value chains. This increasingly is seen as an opportunity by banks, several of which have backed new Fintech partnerships with their balance sheets. Advances in credit decisioning around the world include access to newly available sources of data from e-commerce and other transactions as well as cloud-based accounting software via automated processes. These now feed into machine-learning credit scoring, which being continually refined to improve estimates of default risks and potential losses and work around risks long posed by the information asymmetries inherent in an SME lending. Partnerships have taken a variety of forms, ranging from referrals to white-labeled solutions provision to supported credit risk retained by banks that are more clients than partners. A proactive approach in the UK has mandated referrals to credit platforms be offered to rejected applicants, a requirement the government is proposing banks extend to those they make credit offers in order to strengthen competition and improve terms. For the same reason, the government is also proposing banks be required to offer loans via the platforms used for referrals, enabling SME borrowers to compared terms more easily.

Agreement on need for supportive regulation to enable innovation, partnerships

Consensus was broad-based that regulation had an important role to play in giving scope to innovation, especially around investor protection but also especially on access to data. Access to data, indeed, was seen to be at the core of the new technologies being developed by Fintech firms and traditional banks, in partnerships or on their own. Many agreed these partnerships had considerable potential to improve access to finance and do so faster and reduced cost, assuming supportive and enabling legal and regulatory environments that helped lenders reach broader sources of risk capital beyond insured bank depositors, including via securitizations such as the recent Funding Circle-EIF-KfW issue. There was much favorable comment in that both about the regulatory “sandbox” approach adopted in the UK and favored by the European Commission to allow innovation and experimentation, with adequate protections for investors and against systemic risk. Innovation in SME finance requires changing the wider financing culture. Letting experiments happen and prevailing cultures be challenged should precede more extensive regulation of new SME finance approaches.