There are 200 million small and medium-sized enterprises (SMEs) worldwide that have no access to formal financial services. This represents a $2 billion gap of funds for capital investments and working capital to increase their growth prospects.

Why does this gap exist and who is stepping in to service the SMEs?

Even before the financial crisis of 2008, the SMEs already had difficulty getting a loan from financial services institutions who concentrated their efforts on large corporations, leaving the very small companies to the microfinance institutions. SMEs fell between those two groups with little to no formal financial sector financing.

Now that the financial crisis is behind us, it has become even more difficult for SMEs to secure their funding needs for growth as regulation and enhanced capital requirements have made such loans even more expensive and less interesting to the regulated financial institutions.

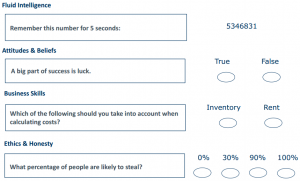

This gap is being filled with companies who use technology to decrease cost and measure risk in a new and efficient way. These companies have created an entire new industry called “fintech” (a contraction of “finance” and “technology” defined as the use of technology and innovative business models in financial services). Through their agility to adapt to the ever-changing financial environment, these companies are disrupting the financial services industry and filling the gap providing financial services to SMEs.