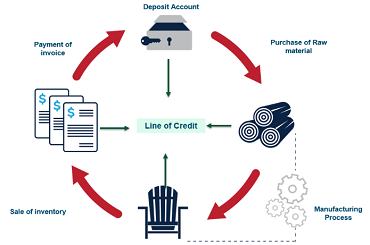

Unified registration mechanism to use movable property, rights as collateral

China has established a unified national financing registration system that uses movable property and rights as pledges, which is expected to increase loans for small and medium-sized enterprises and improve the overall business environment.

The unified system has been expanded across the country since Jan 1, after pilot programs were conducted in four cities-Beijing, Shanghai, Chongqing and Guangzhou in Guangdong province-central bank officials said at a news conference.

The People's Bank of China, the central bank, was authorized by the State Council, China's Cabinet, to take full responsibility for the unified registration system. It started providing support and inquiry services on Jan 1, and the nationwide system is running smoothly, said Zhang Zihong, head of the PBOC's Credit Reference Center.