IFC Financing to MSME

Lack of access to financial services is a key barrier to the growth of micro, small, medium enterprises (MSMEs). IFC is working to develop solutions to close the MSME financing gap. By partnering with many types of financial intermediaries, including microfinance institutions (MFIs), commercial banks, and leasing companies, IFC reaches many more small and medium enterprises (SMEs) than it could directly.

Portfolio Highlights CY2020

*This does not include data reported by Global clients

*This does not include data reported by Global clients

*Portfolio data, for each CY, are not strictly comparable as they are based on the portfolio of IFC clients that changes from year to year)

IFC FI Clients’ Loans to Women and Women-owned MSMEs

| Global | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 24,292 | 15,107 | 45.5% | 15.0% |

| SME | 543 | 16,363 | 4.1% | 3.4% |

| East Asia and the Pacific | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 3821 | 2,853 | 39.3% | 6.3% |

| SME | 222 | 6,641 | 2.4% | 2.2% |

| Europe and Central Asia | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 223 | 438 | 22.1% | 19.4% |

| SME | 82 | 2,935 | 15.7% | 12.5% |

| Latin America and the Caribbean | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 1,328 | 1,171 | 21.1% | 13.4% |

| SME | 107 | 3,425 | 9.5% | 4.8% |

| Middle East and North Africa | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 348 | 334 | 49.5% | 43.2% |

| SME | 1.1 | 30.0 | 2.7% | 0.8% |

| South Asia | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 17,328 | 9,624 | 52.4% | 23.1% |

| SME | 89 | 2,562 | 5.4% | 5.2% |

| Sub-Saharan Africa | ||||

| Number of Loans to Women | Total Volume of Loans to Women | Number of Loans to Women | Total Volume of Loans to Women | |

| Loan | # '000 | $ millions | % of total | % of total |

| Type | ||||

| Micro | 1,195 | 723 | 49.8% | 36.9% |

| SME | 39 | 1,121 | 18.0% | 10.2% |

METHODOLOGY

Purpose of the Reach Data

IFC supports firms that make a wide range of contributions in developing countries. In turn, these firms affect various stakeholders, including customers, employees and their families, local communities, suppliers and other business partners, as well as national and local governments. Reach Data is a tool of measuring the FI clients' development impact and therefore assessing the development results that IFC achieves through its private investments and advisory services in financial sector.

Classification of Clients and Loans

IFC Investment and Advisory clients are mainly classified as "Micro" and "SMEs", according to the following criteria. If the project with the client is specifically focused on developing the client’s MSME business, it may be categorized based on the loan size category:

-

Micro enterprise: loans up to $10,000 at origination;

-

SMEs: loans from $10,000 to $1 or $2 Million at origination ($2 Million for more advanced countries*).

Content of the Reach Data

The following indicators, among others, are collected through the Reach Data survey:

-

Number and volume of outstanding loans of client FIs

-

Number and volume of non-performing loans

-

Number and volume of deposits

For all forms of IFC financing of banks and non-bank financial institutions (equity, quasi-equity, general purpose credit lines etc.) as well as advisory services (Microfinance, SME Banking, Sustainable Energy Finance, Agrifinance, Housing Finance, Risk Management, etc.), the total portfolio of that institution is taken into consideration to arrive at the classification.

Source of Reach Data

Data is obtained directly from the clients by requesting to fill out the standardized template on an annual basis.

Timeline

By collecting Reach Data on an annual basis IFC has an opportunity to track its impact on the market through analysis of trends and development of its clients across different regions. 2019 is IFC’s 15th year of Reach Data collection, where more than 300 clients provided information.

-

The committed portfolio in MSME FIs does not include commitments for commercial banking trade finance and collective investment methods.

-

Nonperforming Loan (NPL) is a loan which is 90 or more days past due.

-

*$2 Million cut-off is used for advanced emerging markets - $2 Million cut-off is used for advanced emerging markets - Argentina, Brazil, Chile, China, Colombia, India, Korea, Mexico, Morocco, Peru, Russia, South Africa, Thailand, Tunisia, Turkey, Poland, Hungary, Czech Republic, Slovakia, the Baltics, and Slovenia.

NPLs

Table 1: Comparative NPLs CY 2019[i]

|

|

Micro Loans |

Small Loans |

Medium Loans |

SME Loans |

Total Retail Loans |

Overall NPL |

W-Micro Loans |

W-SMELoans |

|

|

|

|

|

|

|

|

|

|

|

East Asia and the Pacific |

1.44% |

2.83% |

3.49% |

2.67% |

1.71% |

2.08% |

1.09% |

2.72% |

|

Europe and Central Asia |

16.03% |

5.67% |

7.74% |

6.40% |

4.76% |

5.94% |

2.55% |

2.84% |

|

Latin America and the Caribbean |

5.38% |

3.02% |

1.63% |

3.03% |

4.12% |

3.71% |

3.50% |

3.97% |

|

Middle East and North Africa |

1.40% |

8.82% |

9.66% |

7.77% |

3.31% |

4.44% |

0.48% |

11.57% |

|

South Asia |

7.10% |

3.54% |

3.73% |

3.83% |

3.46% |

3.59% |

0.96% |

9.78% |

|

Sub-Saharan Africa |

7.27% |

7.06% |

1.54% |

6.66% |

6.22% |

6.54% |

6.72% |

13.62% |

|

WORLD |

0.37% |

1.47% |

|

1.33% |

|

1.33% |

0.48% |

|

|

Overall |

5.86% |

3.85% |

3.66% |

3.98% |

3.46% |

3.67% |

1.27% |

3.63% |

Table 2: Comparative NPLs with Corporates CY 2019[ii]

|

|

Micro |

Small |

Medium |

Corporate |

W-Micro |

W-SME |

W- Corporates |

Total Retail Loans |

|

|

|

|

|

|

|

|

|

|

|

East Asia and the Pacific |

1.44% |

2.83% |

3.49% |

1.53% |

1.09% |

2.72% |

0.84% |

1.71% |

|

Europe and Central Asia |

16.03% |

5.67% |

7.74% |

4.44% |

2.55% |

2.84% |

4.61% |

4.76% |

|

Latin America and the Caribbean |

5.38% |

3.02% |

1.63% |

1.28% |

3.50% |

3.97% |

2.91% |

4.12% |

|

Middle East and North Africa |

1.40% |

8.82% |

9.66% |

4.69% |

0.48% |

11.57% |

12.39% |

3.31% |

|

South Asia |

7.10% |

3.54% |

3.73% |

4.23% |

0.96% |

9.78% |

0.07% |

3.46% |

|

Sub-Saharan Africa |

7.27% |

7.06% |

1.54% |

4.79% |

6.72% |

13.62% |

5.96% |

6.22% |

|

WORLD |

0.37% |

1.47% |

|

0.51% |

0.48% |

|

|

|

|

Total/ Overall |

5.86% |

3.85% |

3.66% |

2.70% |

1.27% |

3.63% |

2.58% |

3.46% |

Table 3: Historical NPL[iii]

|

|

SME |

W-SME |

Micro |

W-Micro |

Average |

|

|

% |

% |

% |

% |

% |

|

2019 |

4.0 |

3.6 |

5.9 |

1.3 |

3.7 |

|

2018 |

4.2 |

3.7 |

4.9 |

2.9 |

3.9 |

|

2017 |

3.4 |

4.1 |

3.1 |

1.6 |

3.0 |

|

2016 |

3.5 |

3.2 |

5.1 |

2.0 |

3.5 |

|

2015 |

4.7 |

|

5.5 |

|

5.1 |

|

2014 |

7.0 |

|

5.5 |

|

6.3 |

|

2013 |

5.5 |

|

6.5 |

|

6.0 |

|

|

|

|

|

|

|

|

Average |

4.6 |

3.7 |

5.2 |

1.9 |

3.8 |

[i] IFC and the SME Finance Forum do not guarantee the accuracy, reliability, or completeness of the content included in these NPL estimates.

[ii] Respective client measurement, quality control and standards vary during the process and there are significant client, country, and regulatory variations in NPL provisioning and estimation methods.

[iii] Historical NPL data and portfolio data are not strictly comparable due to several factors including IFC clients changes from year to year, number of data reporting clients varies each year, and currency exchange rate fluctuations.

FACTSHEETS

FACTSHEETS 2018

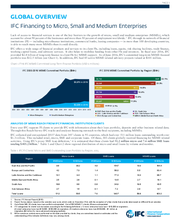

IFC works globally through financial institutions (FIs) to provide much-needed access to finance for millions of individuals and micro, small, and medium enterprises (MSMEs). The lack of access to financial services is one of the key barriers to the growth of MSMEs, which make important contributions to sustainable development, in terms of contributions to economic growth, creation of decent jobs, provision of public goods and services, as well as poverty alleviation and reduced inequality. IFC offers a wide range of financial products and services to its client FIs, including loans, equity, risk sharing facilities, trade finance, working capital loans, and advisory services. It also helps to mobilize funding from other FIs and investors. In fiscal year 2018, IFC provided $2.8 billion of long-term finance to client FIs for MSME support. As of June 2018, IFC’s committed long-term MSME-focused portfolio was $12.1 billion (see Chart 1). In addition, IFC had 129 MSME-related advisory projects with a total project value of $235.7 million.

Factsheets 2017

Lack of access to financial services is one of the key barriers to the growth of micro, small and medium enterprises (MSMEs), which

account for about 90 percent of the businesses and more than 50 percent of employment worldwide.1 IFC through its network of financial

institutions (FI) -- including microfinance institutions, commercial banks, leasing companies -- in more than 100 developing countries,

is able to reach many more MSMEs than it could directly.

IFC offers a wide range of financial products and services to its client FIs, including loans, equity, risk sharing facilities, trade finance,

working capital loans, and advisory services. It also helps to mobilize funding from other FIs and investors. In fiscal year 2017, IFC

provided $3.2 billion of long-term finance to client FIs for MSME support. As of June 2017, IFC’s committed long-term MSME-focused

portfolio was $12.0 billion (see Chart 1). In addition, IFC had 215 active MSME-related advisory projects valued at $225.5 million.

Factsheets 2016

Lack of access to financial services is one of the key barriers to the growth of micro, small and medium enterprises (MSMEs), which account for about 90 percent of the businesses and more than 50 percent of employment worldwide. 1 IFC through its network of financial institutions (FI) — including microfinance institutions, commercial banks, leasing companies — in more than 100 developing countries, is able to reach many more MSMEs than it could directly.

IFC offers a wide range of financial products and services to its client FIs, including loans, equity, risk sharing facilities, trade finance, working capital loans, and advisory services. It also helps to mobilize funding from other FIs and investors. In fiscal year 2016, IFC provided $2.8 billion of long-term finance to client FIs for MSME support. As of June 2016, IFC’s committed long-term MSME-focused portfolio was $12.5 billion (see Chart 1). In addition, IFC had 85 active MSME-related advisory projects valued at $101 million.

FACTSHEETS 2015

IFC offers a wide range of financial products and services to its client FIs that work with local MSMEs, including loans, equity, risk sharing facilities, trade finance, working capital loans and advisory services. It also helps to mobilize funding from other FIs and investors. In 2015, IFC provided $2.9 billion of long term finance to client FIs for MSME support. As of the end of 2015 IFC’s committed long-term finance MSME portfolio was $10.9 billion with 685 investment and 162 advisory projects.

IFC offers a wide range of financial products and services to its client FIs that work with local MSMEs, including loans, equity, risk sharing facilities, trade finance, working capital loans and advisory services. It also helps to mobilize funding from other FIs and investors. In 2015, IFC provided $2.9 billion of long term finance to client FIs for MSME support. As of the end of 2015 IFC’s committed long-term finance MSME portfolio was $10.9 billion with 685 investment and 162 advisory projects.

IFC, through its network of over 200 financial institutions (FI) across 51 IDA countries, including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

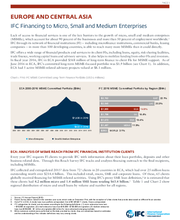

IFC, through its network of over 110 financial institutions (FI) across 24 countries in Europe and Central Asia (ECA), including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

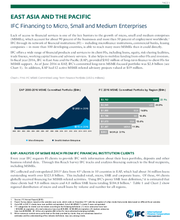

IFC, through its network of over 60 financial institutions (FI) across 12 countries in East Asia and the Pacific (EAP), including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

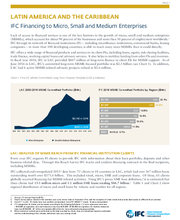

IFC, through its network of over 120 financial institutions (FI) across 21 countries in Latin America and the Caribbean (LAC), including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

IFC, through its network of over 60 financial institutions (FI) across 13 countries in Middle East and North Africa (MENA), including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

IFC, through its network of over 50 financial institutions (FI) across 6 countries in South Asia (SA), including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

IFC, through its network of over 110 financial institutions (FI) across 30 countries in Sub-Saharan Africa (SSA), including microfinance institutions, commercial banks, leasing companies, and private equity funds, reaches many more MSMEs than it could ever do directly.

FACTSHEETS 2014

By the end of calendar year (CY) 2013, IFC’s MSME clients had 29.1 million micro loans outstanding globally, totaling $28.0 billion. Similarly, IFC’s MSME clients had over 5.4 million small and medium loans outstanding by the end of CY2013, totaling $273.6 billion globally.

IFC offers a wide range of financial products, including loans, equity and risk management solutions, to help FIs scale up and enter the MSME market. As of June 2014, IFC committed a total of $14.5 billion to MSME finance globally, $10.3 billion for long-term finance, $2.4 billion for funds supporting MSMEs and $1.8 billion for trade finance. In fiscal year (FY) 2014 alone, IFC MSME commitments globally were $5.8 billion (decrease 3.2 percent from $6.0 billion in FY2013), $2.1 billion of which was attributed to long-term financing.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME1) financing gap, collaborating with 146 financial institutions (FIs) across 41 International Development Association (IDA) countries.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME) financing gap, collaborating with 97 financial institutions across 20 countries in Europe and Central Asia.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME) financing gap, collaborating with 43 financial institutions (FIs) across 12 countries in the East Asia and the Pacific (EAP) region.

IFC is working to develop solutions to close the micro, small,and medium enterprise (MSME) financing gap, collaborating with 65 financial institutions (FIs) across 20 countries in Latin America and the Caribbean (LAC) region.

IFC is working to develop solutions to close the micro, small,and medium enterprise (MSME) financing gap, collaborating with 38 financial institutions (FIs) across 14 countries in the Middle East and North Africa (MENA).

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME) financing gap, collaborating with 36 financial institutions (FIs) across 5 countries in South Asia (SA) region.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME) financing gap, collaborating with 64 financial institutions (FIs) across 21 countries in Sub-Saharan Africa (SSA) region.

IFC travaille à l’élaboration de solutions pour résorber le déficit de financement des microentreprises et petites et moyennes entreprises (MPME) d’Afrique subsaharienne, en collaboration avec 64 institutions financières (IF) de 21 pays de la Région SSA.

FACTSHEETS 2013

IFC Outreach Data and Brochures communicate achievements and showcase successes in our MSME Access to Finance Strategy. They present aggregated results achieved by IFC supported financial intermediaries with their MSME clients.

IFC offers a wide range of financial products, including loans, equity and risk management solutions, to help FIs scale up and enter the MSME market. As of June 2013, IFC committed a total of $14.5 billion to MSME finance globally $12.8 billion for long-term finance (including $2.3 billion for funds supporting MSMEs), and $1.7 billion for trade finance. In fiscal year (FY) 2013 alone, IFC MSME commitments globally were $6 billion(up 11.5 percent from $5.4 billion in FY2012), $2.6 billion of which was attributed to long-term financing.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME1) financing gap, collaborating with 129 financial institutions (FIs) across 39 International Development Association (IDA) countries.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME ) financing gap, collaborating with 103 financial institutions (FIs) across 22 countries in Europe and Central Asia (ECA) region.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME ) financing gap, collaborating with 34 financial institutions (FIs) across nine countries in the East Asia and the Pacific (EAP) region.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME ) financing gap, collaborating with 62 financial institutions (FIs) across 19 countries in Latin America and the Caribbean (LAC) region.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME ) financing gap, collaborating with 32 financial institutions (FIs) across 12 countries in the Middle East and North Africa (MENA).

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME ) financing gap, collaborating with 29 financial institutions (FIs) across 4 countries in South Asia (SA) region.

IFC is working to develop solutions to close the micro, small, and medium enterprise (MSME1 ) financing gap, collaborating with 54 financial institutions (FIs) across 20 countries in Sub-Saharan Africa (SSA) region.

CLIENTS

IFC is collaborating with more than 300 financial institutions across over 90 countries. By partnering with many types of financial intermediaries, including microfinance institutions, commercial banks, and leasing companies, IFC reaches many more small enterprises and SMEs that it could directly. Learn more about our clients.

CONTACT US