MSME Finance Gap

Micro, Small and Medium Enterprises (MSMEs) are one of the strongest drivers of economic development, innovation and employment. Access to finance is frequently identified as a critical barrier to growth for MSMEs. Creating opportunities for MSMEs in emerging markets is a key way to advance economic development and reduce poverty. The private and public sector can better address this matter if they have better insights about the magnitude and nature of the finance gap. Hence, sizing MSME finance gap is crucial for the governors, financiers and other private sector players to target high potential growth areas and hence more efficiently support MSME sector development. Responding to such demand, this study has used an innovative methodology to estimate that:

131 million or 41% of formal MSMEs in developing countries have unmet financing needs

MSME finance gap in developing countries is estimated to be approximately $5 trillion - 1.3 times the current

level of MSME lending

Women-owned businesses comprise 23% of MSMEs and account for 32% of the MSME finance

gap

MSME Finance Gap as % of GDP

Financially Constrained Enterprises as a % of Total Enterprises of the Same Size

This represents the estimated number of micro, small and medium enterprises in developing countries. Micro enterprises are defined as those with less than 10 employees while small and medium enterprises (SMEs) are defined as those with 11-250 employees

Number of Enterprises by Gender (in thousands)

These charts show the breakdown of men versus women owned enterprises in developing countries. Women-owned enterprises are one of the following:

- Option 1: At least 50 percent female ownership, OR Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

- Option 2: Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

Number of Formal Enterprises by Level of Financial Constraint (in thousands)

Compare with

Formal MSME Finance Gap

Number of Formal Enterprises by Size

Number of Enterprises by Gender

Number of Formal Enterprises by Level of Financial Constraint

Formal Finance Gap by Gender

Formal Finance Gap by Firm Size

What does MSME finance gap mean?

MSME finance gap is estimated as the difference between current supply and potential demand which can potentially be addressed by financial institutions. The MSME finance gap assumes that the firms in a developing country have the same willingness and ability to borrow as their counterparts in well- developed credit markets and operate in comparable institutional environments — and that financial institutions lend at similar intensities as their benchmarked counterparts.

How is the MSME finance gap calculated?

The methodology used to calculate the MSME finance gap has three major steps:

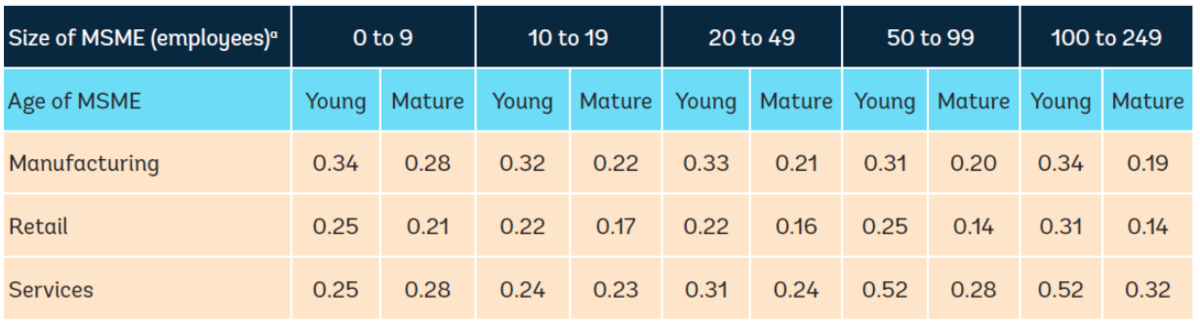

Step 1. Benchmarking. At first, the methodology entails benchmarking the prototypical financing environment where MSME credit markets function with minimal imperfections. The mean debt-to- sales ratio is computed across firms operating in the ten benchmarked countries (Australia, Canada, Denmark, Germany, Ireland, Israel, New Zealand, Switzerland, the United Kingdom, and the United States), as presented in the table below:

Step 2. Potential Demand for MSME Finance. These benchmarks are subsequently applied to the universe of MSMEs in each category operating in the emerging economies where the gap is to be calculated. This results in the estimated “potential demand”.

Step 3. Existing Supply of MSME Finance. Existing lending to MSMEs by financial institutions was available for 71 countries mainly from the IMF’s Financial Access Survey (FAS), and the OECD’s SME Scorecard. For the remaining countries, an cross-sectional OLS regression framework was used to predict the missing MSME volume: MSME Lending= α{MSME} + β{Macro} + γ{Banking} + η

MSME Finance Gap

Bringing together the potential demand calculated in step 2 with the current supply collated/computed in step 3 produces the MSME finance gap for each country.

MSME finance gap = Potential demand – Existing supply

What were the data sources used?

MSME data availability and quality in emerging countries remains a significant barrier for researches and practitioners. To address the problem of data quality and scarcity, the authors of this study have expanded and diversified the data sources, which now include Bureau Van Dijk – Orbis data, the International Monetary Fund (IMF) Financial Access Survey data, the Organisation for Economic Co-operation and Development (OECD) Financing SME and Entrepreneurs Scoreboard, and the World Bank Enterprise Survey data, among others. In addition, missing data has been extrapolated using an approach with solid statistical grounds, which is replicable, allowing the database to generate better results as better data comes in. It is also well-documented for those interested in replicating or refining the results.

What are the drawbacks of using these data sources?

The data sources, surveys and studies mentioned above lack cross-country harmonization. Thus, detailed firm-level data with comprehensive information about current financial standing and financing needs are unavailable at the global level. This restriction implies that any estimation of the financing gap has to rely on less complex, firm-level data sources, for example, data collected by the World Bank

Enterprise Surveys. The lack of data also imposes the need to make stronger assumptions than would be necessary if data availability was not an issue.

The lack of uniform data about the informal MSME market segment represents an especially serious constraint. Multiple agencies are working on collecting data from microfinance institutions, including MIX and the Groupe Speciale Mobile Association (GSMA) or mobile network operators, where many informal enterprises might be traced. However, there is no governing body or unified data aggregator which can be confidently used as a source of informality data across all developing countries.

How is the current methodology different from the previous one?

IFC’s previous MSME finance gap study, conducted in 2010 in conjunction with McKinsey, used firm- level datasets to identify enterprises that were credit constrained. It also made assumptions regarding how much these enterprises would want to borrow.

The problems with the previous approach are primarily twofold: (1) the assumptions about how much credit constrained firms would borrow was highly arbitrary; and (2) the counterfactual under which the gap exists was not well defined. The problem stemming from the counterfactual definition was that it was difficult to comprehend the total increase in the demand for finance. The changes in the enabling environment would not only allow an expansion of access to those MSMEs currently without sufficient financing, but would also trigger even more borrowing by those MSMEs that currently had financing. On the supply side, the lack of a definition of the counterfactual also raised uncertainty about the bankability of those currently unserved or underserved MSMEs. In fact, the previous methodology did not consider how much financial institutions would want to finance. Hence, the bankability consideration was entirely absent.

The current methodology defines the counterfactual more concretely. By relying on a benchmarking approach, the regulatory and macroeconomic changes required for the gap to manifest are clearly defined.

MSME Finance Gap Database (Updated Oct 2018. Please see the README file for a summary of changes)

MICRO enterprises are defined as those with less than 10 employees

SMALL AND MEDIUM ENTERPRISES are defined as those with 11-250 employees

LEVEL OF FINANCIAL CONSTRAINTS

Fully credit-constrained firms are defined as those that find it challenging to obtain credit. These are firms that have no source of external financing. They typically fall into two categories: those that applied for a loan and were rejected; and those that were discouraged from applying either because of unfavorable terms and conditions, or because they did not think the application would be approved. The terms and conditions that discourage firms include complex application procedures, unfavorable interest rates, high collateral requirements, and insufficient loan size and maturity.

Partially credit-constrained firms are defined as those that have been somewhat successful in obtaining external financing. PCC firms include those that have external financing, but were discouraged from applying for a loan from a financial institution. They also include firms that have an external source of financing, and firms that applied for a loan that was then partially approved or rejected.

Non-credit-constrained firms are those that do not appear to have any difficulties accessing credit or do not need credit. Firms in this category encompass those that did not apply for a loan as they have sufficient capital either on their own or from other sources. It also includes firms that applied for loans that were approved in full.

WOMEN-OWNED ENTERPRISES

At least 50 percent female ownership, OR Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

Option 1: At least 50 percent female ownership, OR Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

Option 2: Sole Proprietorships that are female-owned, OR female participation in ownership and management (top manager).

The POTENTIAL DEMAND expresses the amount of financing that MSMEs would need, and financial institutions would be able to supply if they operated in an improved institutional, regulatory and macroeconomic environment.

|

Sandeep Singh Sector Economics and Development Impact (IFC) |

| ssingh13@ifc.org |