We're proud to share that our members 4G CAPITAL GROUP Limited (“4G CAPITAL”) and Citi with the U.S. International Development Finance Corporation (“DFC”) and the Ford Foundation have collaborated to expand financial inclusion through the provision of working capital to support the growth of micro-enterprises in Kenya.

4G Capital will receive a KES 285M term loan from Citi that will reach more than 25,000 micro-enterprises. As part of the collaboration, 4G Capital and Citi will work to address the inventory finance needs of last-mile distributors of fast-moving consumer goods (FMCGs). The loan is part of the Scaling Enterprise guarantee facility, a Citi partnership with DFC and the Ford Foundation that enables earlier stage, innovative and inclusive businesses in emerging markets to access local currency commercial bank financing.

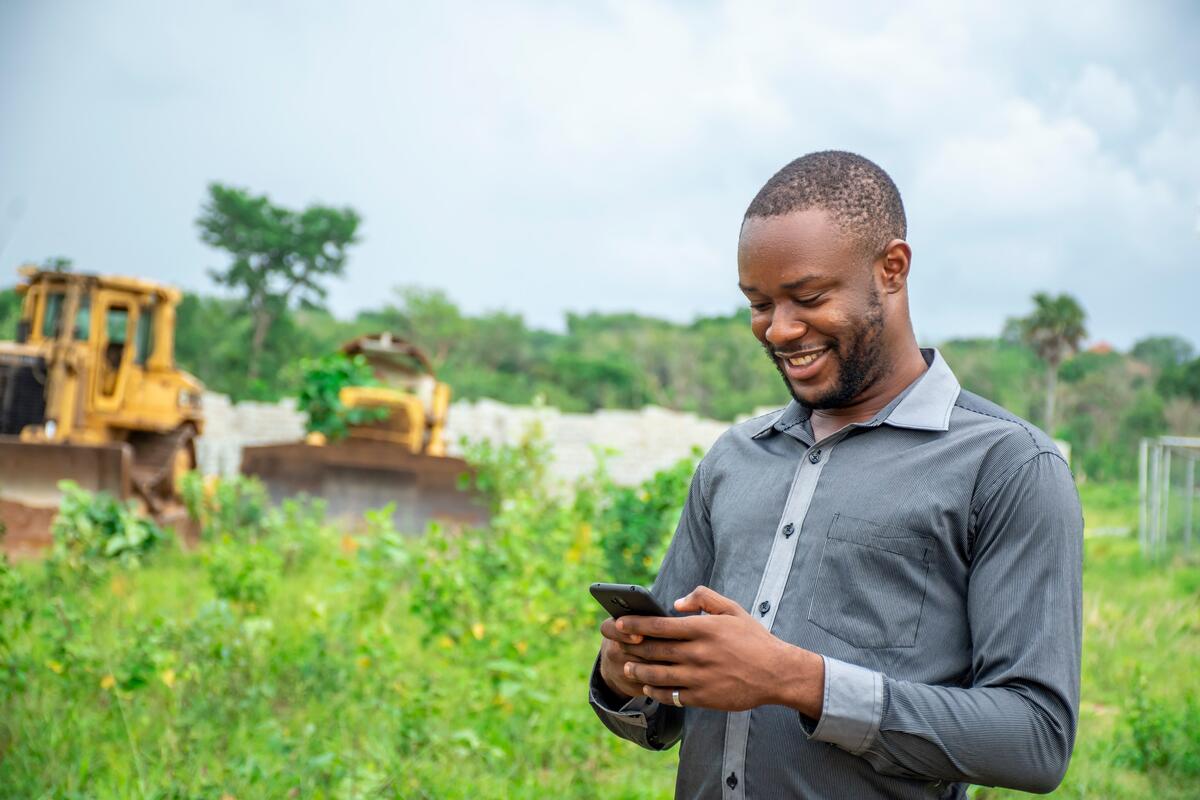

Citi is a primary banker to FMCGs across Africa and seeks to assist its clients in expanding their businesses sustainably through the responsible provision of working capital credit to their MSME customers. 4G Capital will support Citi’s FMCG customers with its KUZA product that uses the company’s proprietary fintech to ‘plug and play’ with partner systems allowing businesses to buy on credit, rather than paying cash on delivery. This allows small shop owners to maintain minimum stock levels for continuous operation and increase order sizes, boosting their annual revenue by 82% on average, according to Technoserve, one of 4GCapital’s partners. Distributors and vendors report increased sales of 30% and higher using 4G Capital’s services. The key to 4G Capital’s success is a combination of client-centric product design supported by an in-house machine learning algorithm that optimises loan terms for the borrower—resulting in high touch and high tech business model. In addition to the revenue growth, clients report 96% increased financial literacy and deliver a net promoter score (which measures customer satisfaction) of 82 out of 100. 81% of 4G Capital’s clients are women entrepreneurs.

For over seven years, 4G Capital has supported East African micro-enterprises by providing financial literacy and enterprise training combined with right-sized working capital credit to help small businesses grow sustainably. 4G Capital customers receive bespoke business training programs and credit guidance via mobile apps and in-person via a nationwide network of branches. 4G Capital’s unique machine learning technology delivers high fidelity insight into customer risk and affordability. As a result, 4G Capital consistently achieves high collections rates without collateral or refinancing its clients, only lending to viable businesses on terms that are right for them.

About Citi:

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management].