Blog

Covid+Fintech: Finally a Game Changer for SME Financing?

Just six years ago, more than half of SME retailers’ transactions were paper based – in the form of cash or cheques. That world is long gone. Why? A large part is because Covid-19 gave digital payments a huge boost. The pandemic made many physical transactions impossible over a significant period, and made digital alternative payments, whether by card, mobile, or internet, necessary for small business survival. Covid also made e-commerce much, much more attractive, even for the smallest merchants.

Difficult customers

Why does this completely change the game for SME financing? We must recognise that, whatever banks might say about how important SMEs are in public, in private, small firms have been very difficult customers. Banks cannot serve SMEs with the same, intensive approaches used for large corporates. Nor could they serve this segment with the highly automated approaches they used for consumers.

The corporate approach proved unaffordable, as small ticket customers don’t pay enough to afford expensive risk assessments and management strategies. The automated consumer approach also proved unreliable, as risk management for businesses involves additional factors that consumer credit information providers don’t provide. Lenders were left to make decisions based on little information, leading to poor credit decisions and poor SME portfolio performance ex post.

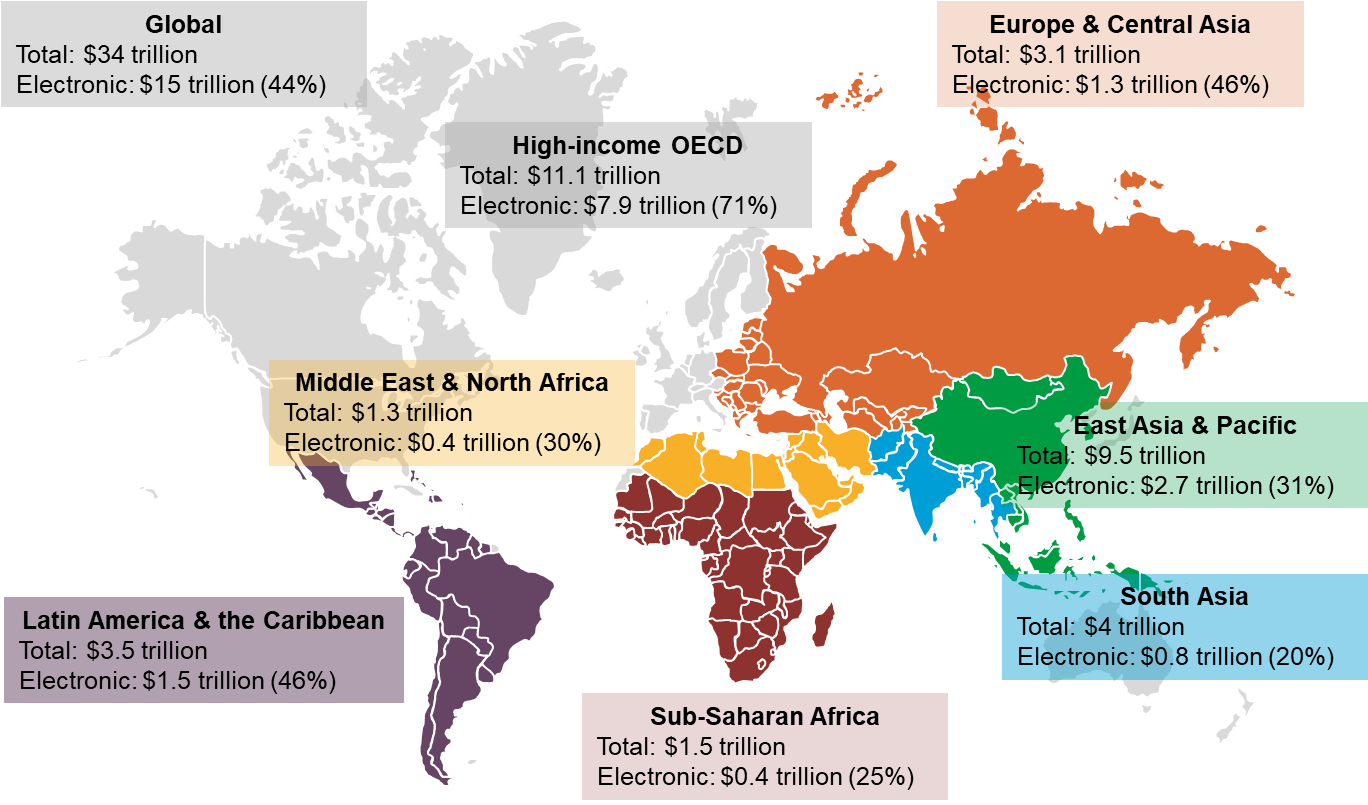

In 2016, an estimated USD 19 trillion was made in paper-based transactions to micro, small and medium-sized retailers

A unique opportunity

Fintech can fill that gap. New models show great promise, tapping into real-time transactional data from SMEs, enabling quicker, better informed decisions on capital needs and risk. New entities in this space include Kabbage and Funding Circle in developed markets, and Ant Financial, WeBank, eFactor, Fawry Microfinance, Lidya, in emerging markets. While previous models relied on entrepreneurs supplying their own data, and expensive field staff to validate performance, fintechs work differently. The alternative financiers don’t sit back like traditional bankers and expect the entrepreneur to show up with the information required. Nor do they send highly-pressured, incentives-driven field staff to get needed data from the workplace – both inefficient strategies that raise costs and necessary interest spreads.

Instead, these data-driven newcomers get basic permissions from entrepreneurs, and then pull the data they need in seconds from digital infrastructure, making key lending decisions on credit within a few seconds. Ant Financial/MyBank has made famous its 3-1-0 approach to business lending: 3 minutes for the on-line application, 1 minute for the decision and transfer of funds, 0 physical human contact required! Ant is now sharing that technology in partnerships not only in China, but also in Southeast Asia and elsewhere.

Management boost

The “Fintech” approach to SME financing also helps improve ongoing management. Fintechs can pull client data in real-time to improve management throughout the lending cycle. Portfolio management becomes far more efficient, and more potentially responsive to changes in the business cycle – responsiveness bankers could only offer for big-ticket customers previously.

We’ve seen better reach to US small businesses when the Treasury and Small Business Administration opened the second phase of the Paycheck Protection Program to Fintechs (and to Fintech-bank partnerships). Lendio, for example, helped many US smaller banks to access the program, as did Biz2x.

Finally, the huge boost in digital transactions has catalysed the development of platforms that combine market and management services for SMEs alongside financial services. Platforms such as Grab in SE Asia, Mercado Libre in Latin America, and Amazon/Google/Facebook in the US (now spreading more widely) began by offering market and information services for entrepreneurs, but then added financing options.

We have long realised that SME financing only addressed part of the problem facing SME development. But trying to tackle the multiple challenges of access to markets and access to business management skills, on top of financing, seemed impossible even a few years ago. Today “embedded finance” is all the rage, and it’s basically about making finance a seamless part of these other critical services, both for businesses and for consumers.

Addressing the risks

These developments are very exciting, but they are not without risks. The world still lacks modern, tech-driven standards to counter financial crime. This leaves large correspondent financial institutions operating in cross-border trade using highly labor-intensive, expensive systems for compliance. Payments still are slow and opaque in most markets (still based largely on 1920s telex technology for cross border payments), though instant payments are on the rise. Trade finance and logistics/customs/excise documentary procedures remain heavily paper-based, having departed little from their original 14th century Venetian origins. There are also risks that data provided from SMEs will be shared and used in ways that penalise them, making data protection an important matter.

Finally, while more and more valuable digital data is being generated by SMEs, too much critical data is housed in walled gardens under individual company control. As markets mature, these data silos can restrict trade and opportunity. This is a problem which, again will fall more heavily on the shoulders of small-scale entrepreneurs. The same nimble tech innovators who have driven progress over the past few decades could in time become anchors that drag back future progress. We need to find ways to promote more open and competitive data infrastructures, where informed customer consent drives data availability, and where all market participants have equal access to permissioned customer information.

Seizing the opportunity

Fintechs were trendy long before Covid-19 – but relatively few focused on SMEs. Covid, by accelerating the transition to alternative, digital payments everywhere, has opened up new opportunities in the heretofore “impossible” SME market. Today fintechs and bank-Fintech partnerships are scaling up digital SME financing models in all parts of the world. New digital market ecosystems under construction promise even more opportunities to come. Yet to realise their great promise, emerging risks need to be well managed. And for that, standards setters will need to up their game (but that’s for a future blog).…