Our events

Virtual Roundtable Series #29 - The Role of Alternative Data in Ensuring Access to Finance for SMEs post-COVID

- What is ‘alternative data’? How is it being collected? From what sources?

- How do lenders use the alternative data? What is the value-added of using alternative data in addition to traditional data?

- What is the correlation coefficient between traditional credit scores and predictions derived from alternative data?

- Do the benefits of the use of alternative data outweigh the cost of its collection and analysis?

- What are the best practices in the governance of alternative data and ensuring fair and transparent risk management using alternative data?

- Will alternative data supplant traditional data or provide a symbiotic addition?

- How will alternative data reshape the ecosystem of the business information industry?

Khrystyna Kushnir is the Knowledge Management Lead at the SME Finance Forum. She has over eleven years of work experience in private enterprise and financial sector development. Before joining the Forum, Khrystyna worked as an operations analyst at the Development Economics of the World Bank Group. Prior to working for the World Bank Group, she was a Research Assistant for Central and Eastern Europe at the Heritage Foundation. Ms. Kushnir also worked, as a Research Analyst, for the Japanese consultancy Washington CORE on Russian and Asian markets. Ms. Kushnir holds MA in International Economic Relations from the American University and is a Fulbright scholar.

Khrystyna Kushnir is the Knowledge Management Lead at the SME Finance Forum. She has over eleven years of work experience in private enterprise and financial sector development. Before joining the Forum, Khrystyna worked as an operations analyst at the Development Economics of the World Bank Group. Prior to working for the World Bank Group, she was a Research Assistant for Central and Eastern Europe at the Heritage Foundation. Ms. Kushnir also worked, as a Research Analyst, for the Japanese consultancy Washington CORE on Russian and Asian markets. Ms. Kushnir holds MA in International Economic Relations from the American University and is a Fulbright scholar.

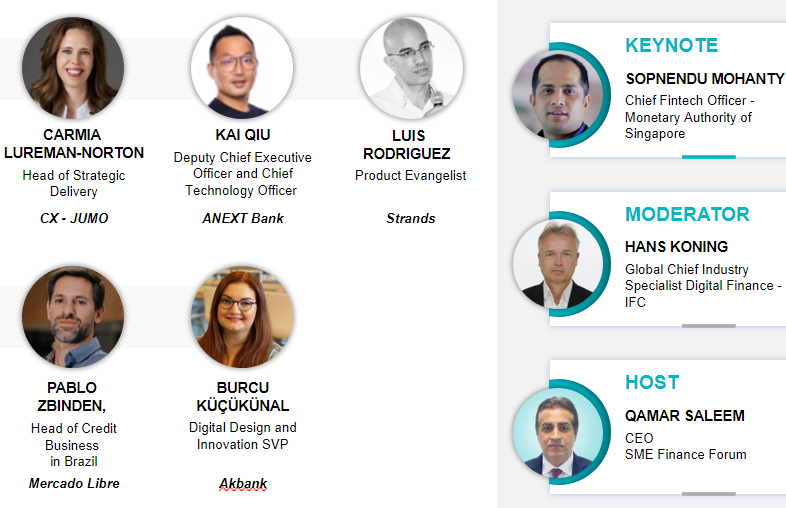

Speakers

Neil Munroe is the Deputy Managing Director, BIIA, and Deputy Chair, International Committee on Credit Reporting (ICCR). Neil has 35 years’ experience in the financial services and credit reporting industries. He is currently Deputy Managing Director of the Business Information Industry Association (BIIA), which is registered in Hong Kong and whose membership consists of more than 70 information companies. Neil is also a founding member of the International Committee on Credit Reporting (ICCR) that is hosted by the World Bank and was personally involved in the creation of the World Bank Principles of Credit Reporting, the recognised standards for the industry. He was elected Deputy Chair in November 2019.

Neil Munroe is the Deputy Managing Director, BIIA, and Deputy Chair, International Committee on Credit Reporting (ICCR). Neil has 35 years’ experience in the financial services and credit reporting industries. He is currently Deputy Managing Director of the Business Information Industry Association (BIIA), which is registered in Hong Kong and whose membership consists of more than 70 information companies. Neil is also a founding member of the International Committee on Credit Reporting (ICCR) that is hosted by the World Bank and was personally involved in the creation of the World Bank Principles of Credit Reporting, the recognised standards for the industry. He was elected Deputy Chair in November 2019.

Tony Hadley is the Senior Vice President of Public Policy for Experian. Tony leads the US domestic and global regulatory and public policy functions for the Experian group of companies. His team manages legislative and regulatory initiatives relating to data-driven marketing, data analytics, credit reporting and risk management, financial markets, health IT, and e-commerce. Tony oversees similar activities in the Americas, EMEA, and Asia Pacific. Tony communicates and aligns Experian’s position on legislative, regulatory, and policy issues with its clients and stakeholders, including multi-lateral groups, international organizations and policymakers, the US Congress, regulatory agencies, and consumer and professional groups. He represents the corporation’s interests before trade alliances including the Association of National Advertisers, Consumer Data Industry Association, the U.S. Chamber of Commerce, the American Financial Services Association, and Consumer Bankers Association. He aligns policy with several international organizations, including the Trans-Atlantic Business Council; the US-Brazil Business Council; the US-India Business Council, and the US-ASEAN Business Alliance.

Tony Hadley is the Senior Vice President of Public Policy for Experian. Tony leads the US domestic and global regulatory and public policy functions for the Experian group of companies. His team manages legislative and regulatory initiatives relating to data-driven marketing, data analytics, credit reporting and risk management, financial markets, health IT, and e-commerce. Tony oversees similar activities in the Americas, EMEA, and Asia Pacific. Tony communicates and aligns Experian’s position on legislative, regulatory, and policy issues with its clients and stakeholders, including multi-lateral groups, international organizations and policymakers, the US Congress, regulatory agencies, and consumer and professional groups. He represents the corporation’s interests before trade alliances including the Association of National Advertisers, Consumer Data Industry Association, the U.S. Chamber of Commerce, the American Financial Services Association, and Consumer Bankers Association. He aligns policy with several international organizations, including the Trans-Atlantic Business Council; the US-Brazil Business Council; the US-India Business Council, and the US-ASEAN Business Alliance.

Rajeev Chalisgaonkar is the Global Head of Business Banking at Standard Chartered Bank. Rajeev has more than 23 years of experience in Corporate, Commercial and Retail Banking across diverse geographies including Europe, the Middle East, Africa, and India. Rajeev heads Business Banking for Standard Chartered Bank globally since April 2014. In his previous assignment, Rajeev was Head of Corporate Banking with Barclays Bank India and before that led the SME and Business Banking for Barclays Emerging Markets across 14 countries in Asia, Middle East and Africa. Prior to joining Barclays, Rajeev worked for Citibank and Export-Import Bank of India holding leadership positions in Central Europe and India. Rajeev completed his MBA at IIM Calcutta. His academic achievements also include a Bachelor of Engineering (Metallurgical Engineering) from Malaviya National Institute of Technology, India.

Rajeev Chalisgaonkar is the Global Head of Business Banking at Standard Chartered Bank. Rajeev has more than 23 years of experience in Corporate, Commercial and Retail Banking across diverse geographies including Europe, the Middle East, Africa, and India. Rajeev heads Business Banking for Standard Chartered Bank globally since April 2014. In his previous assignment, Rajeev was Head of Corporate Banking with Barclays Bank India and before that led the SME and Business Banking for Barclays Emerging Markets across 14 countries in Asia, Middle East and Africa. Prior to joining Barclays, Rajeev worked for Citibank and Export-Import Bank of India holding leadership positions in Central Europe and India. Rajeev completed his MBA at IIM Calcutta. His academic achievements also include a Bachelor of Engineering (Metallurgical Engineering) from Malaviya National Institute of Technology, India.