Blog

IFC Annual Digital Finance Partners Meeting - Singapore May 23-24

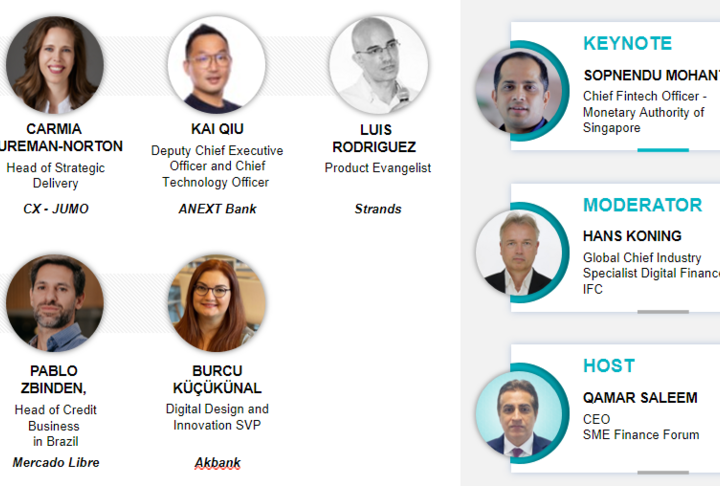

The SME Finance Forum was very pleased to be asked to assist in IFC’s annual Digital Finance Partners meeting. This meeting attracted well over 100 participants from some 40 countries: Fintech partners, fintechs interested in partnerships, IFC client financial institutions, IFC investment and advisory staff. The even took place over 2 days. The first day was full of interesting panel discussions and speeches. Vivek Pathak, IFC’s Director for East Asia-Pacific, kicked off the meeting by speaking from the heart about his years as a banker in a large multinational, where they really couldn’t deal with smaller clients using their old technology – but he marveled at how the field is now changing, and how new technology is changing all this, making “banking the base” truly viable. Jonathan Turner of the British High Commission gave a most useful talk on his government’s support for such innovation (the key meeting sponsor, through UKAid), and noting how the HIFI project, managed by IFC and implemented by the entire World Bank Group, already is reaching over 90 million people with new access to finance. Margarete Biallas, from IFC’s Digital Finance Group, gave a most useful industry overview to round out the keynotes. Then we went through panels, such as:

Offense of Defense: Where do banks create opportunities to use digital transformation to expand and grow in new areas: the likes of @paypal, @FINO, @TelenorBank (which recently took over Tamir Microfinance Bank and Easy Paisa in Pakistan), @DBSBank and SME Finance Forum member @DiamondBank shared specific experiences

Connecting the Dots: How should financial institutions and non-banks address operational challenges, partner and build capacity: where new SME Finance Forum member @BBVA, longstanding member @StandardChartered and (we hope) incoming member @FidorBank shared their digital banking models and approaches.

Analytics or intuition: Data-driven financial services: is it the future? Where @Baidu, @Branch and @Cignifi described how they’re mining cellphone, internet, social media and other data to support services to new segments. This section was particularly useful in light of the work we are about to produce for the G20 on alternative data and how it’s changing SME Finance (watch this space!)

Banking the Value Chain: How can we leverage the existing supply and distribution chains to provide better service to MSMEs? Here SME Finance Forum members @Alipay@AntFinancial and @Fawry joined with @TiendaPago, @EconetWireless and @BankSouthPacific to share their innovative experiences in various supply and distribution chains.

Embedded Finance: where financial services are embedded in a larger relationship, about transport with @UBER, SME accounting through @XERO, Health Services through @iCareBenefits, rural power through @Mobisol (see them in a study tour at the Global SME Finance Forum, Berlin, 1-3 November), and agri-commodity management through @SLCMGroup.

View from innovation: this is where we talked about the newest frontiers, where speakers from @IBM, @EightCapital, @iSPIRIT and @ADDOAI discussed blockchain, AI, biometric and other technologies which can take work even farther, to even more difficult segments.

Day TWO was our day, at which we arranged a part-Finovate, part-Innotribe, part our own version of “pitch and palaver” for 13 Fintech Companies. We organized them by the (quite rough) different areas they focus on:

Big data, AI and credit scoring: @Banhji, @Sqreem, SME Finance Forum member @Strands, SME Finance Forum member @VerdeInternational, and @Moneythor

Payment Services and Invoice Financing: @Incomlend, @Invoiceinterchange, @Matchmove and @Fidor

Digital Banking Solutions: @Chekk, SME Finance Forum member Digivation’s @GlobalLinker, SME Finance Forum member @Mambu, and @Timo.

Most of the presentations and pitches will be available through this event website and through the SME Finance Forum website.