Blog

Partnerships to Grow SME Finance

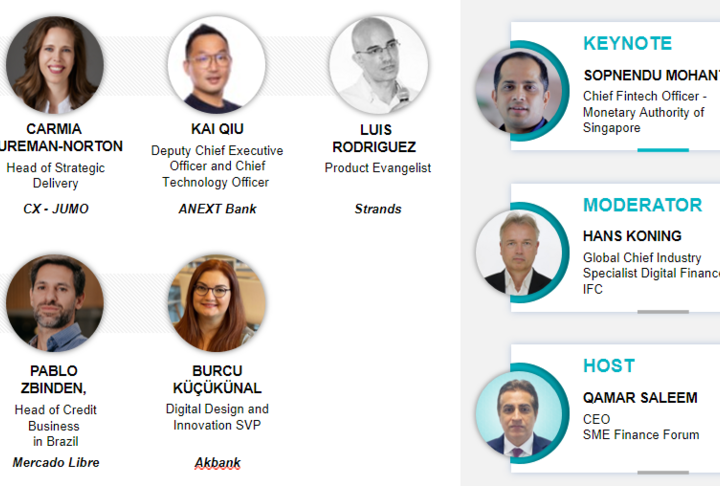

This blog is the summary of the virtual marketplace from March 9th, the SME Finance Forum hosted this event featuring three fintech and one DFI (Development Finance Institution) to share their experiences and different products and services in SME Finance. In this online session, Robert Scheunpflug (Shanghai F-Road Commercial Services Co. Ltd), Ian Sayers (International Trade Center), Michael Wilkerson (Tugende), and Zigha Ayibakuro Timothy (Zal Group) presented their products and innovative solutions during the marketplace. The event was powered by GlobalLinker, an AI-driven Digital Ecosystem offering SMEs a range of services to build a digital presence in e-commerce.

An Innovative Data Collection Model on SME Clients: Turning Informal SMEs Data into Trustworthy Information for Loans

Robert Scheunpflug, Deputy Manager of Smart Credit Department and Senior MSE expert at F-Road, presented F-Road's innovative method of collecting data on their MSME clients in China. While China has a digitally advanced lending environment, most digital finance is for consumer lending and leaves several SMEs out of digital lending. SME Financing in China requires more than the 6.5 million RMB (1 USD=6.37RMB) provided by the banks. F-Road uses a product fingertip lending model that local banks can use to process loans for offline informal MSMEs. The system provides an end-to-end loan origination platform that can be used in the cloud or internalized with a bank's own system. That system allows F-Road to understand the specific credit risk and understand the client's financial information without the need for 3rd party data sources. F-Road relies on three major models:

1) how to ask,

2) how it can be smooth, and

3) how to decide.

The first model involves onboarding the informal client's information in the digital platform through 20 questions to establish a first Profit and Loss statement and a Financial Statement. In the second model, F-Road finds the profit of those SMEs by looking at the numbers and ratios from the first model to determine the correct, trustworthy value. Finally, in the last model, F-Road decides on whether the SME is eligible for the loan or not through its own 100,000 client database. The model allows F-Road to work in areas without reliable data and gives SMEs the loans they require in the Chinese market.

Connecting SMEs in Eastern and Southern Africa to Available SME Financing

Ian Sayers, the Senior Adviser for Access to financing and investment at the International Trade Centre (ITC) in Geneva, introduced ITC's efforts to provide SMEs access to finance in East/South Africa. Moreover, ITC noticed that 70% of ITC's SME clients around the world say that the key problem is predictable short-term financing for deals despite data highlighting that risk is low when an SME has a presence in a structured supply chain. ITC introduced two new facilities in Eastern and Southern Africa in March to counter the lack of financing.

The first facility makes the process much more fluid and accelerates lending and growth. It has rolled out in Tanzania with two pan-African banks and in Kenya. With the Eastern and Southern African Trade and Development Bank and the Trade and Development Fund, the first facility connects ITC's SME upgrading work with local banks in the countries to pre-qualify enterprises for short-term trade loans. The scheme assists MSME-facing banks in preparing the enterprises to be qualified for business, addressing the lack of collateral. Thus, the SMEs can win an order or get a letter of intent to turn to these financial providers and get a quick decision on their loans.

The second facility is known as MSME Financing Gateway. The gateway provides sources of financing and organizers in a country in several languages with layered graphics and text. SMEs can filter and select financing options that match their needs. It is up and running in Kenya, Uganda, and other countries to follow. The gateway aims to introduce enterprises to more financing providers than the 7 to 8 providers dedicated to their kind of business. The gateway also provides analytical reports that help SMEs find appropriate funding sources.

From Leasing Motorcycle Taxis to Fintech Financing in Africa

Michael Wilkerson, CEO and founder of Tugende, explained how Tugende has grown from a leasing company to a fintech company in Uganda. Tugende uses a customer-centric model to take control of financial features and use the information collected to build a digital profile for their clients, even if they do not have a digital presence. Most SMEs struggle to qualify for loans because of a lack of collateral. Motorcycle taxis are an example of collateral need where there might be no alternatives to access farms/rural areas. Tugende started by helping motorcycle taxis from renting to owning motorcycles and provided those clients with asset financing. There are two key components in Tugende's platform:

1) MSME asset finance package today.

2) Long-term ecosystem unlocked by proven performance and digital profile by helping clients and their networks keep growing.

Tugende uses a branch-based model. It first onboard the client, digitally collecting all Know Your Client (KYC) data through high-touch credit screening. Clients choose the type of asset, and they go from renting to owning those assets over time and leverage those assets in their favor. Tugende creates a T-score using the data and application of customers and applies it using the repayment history of customers. It has served over 50k clients with over 1% write-offs. Their customers now have cash flow and a recoverable asset that can be used as asset collateral. Tugende spends nothing on customer acquisition due to the extensive waiting list due to more demand than the available supply of SME financing. Tugende also helps customers acquire more than income-generating assets such as cars and tractors as it widens the asset entry point. Tugende aims to develop partnerships, expand to other countries, and turn its data into an SME bureau to help other lenders and data providers.

Developing SME Capacity in the Niger Delta Region

Zigha Ayibakuro Timothy, CEO of Zal Group, introduced the group's work on helping SMEs build capacity to grow and compete in the Niger Delta markets. Zal Group provides support functions and services to SMEs to become competitive in the market. It provides support services such as linkages to markets and finance provisional technical assistance. They help SMEs overcome basic eligibility issues in the market, such as compliance issues, solvency issues, and linkages issues. In the past five years, Zal hosted the Business Linkage Forum hosting over 2000 businesses and different stakeholders such as banks and financial institutions. These financial institutions understood the challenges businesses face in the Niger Delta region through the forum. The group teaches SMEs to attract institutional buyers and become part of their value change. The group managed to provide access to finance for over 200 businesses and upscale their investments in SME growth and development. Such efforts include building a tech hub or creating boot camps to help SMEs become competitive in the marketplace. Still, there is a lack of financing for SMEs in the region and the need for more institutional stakeholders to bridge the gap. The Niger Delta region still has a long way to go as a low supply of financing is available.

About the fintech presenters

Shanghai F-Road Commercial Services Co. Ltd

Shanghai F-Road focuses on mobile financial services. It is dedicated to providing mobile financial services via mobile terminals and offering comprehensive solutions of mobile banking to regional banks.

International Trade Centre (ITC)

ITC is the joint agency of the World Trade Organization and the United Nations. It is the only development agency that is fully dedicated to supporting the internationalization of SMEs.

Tugende

Tugende is tackling the credit gap for small businesses in Africa by enabling informal entrepreneurs to 1) own income‑generating assets, 2) build a verifiable digital credit profile, and 3) earn future growth opportunities through the Tugende digital platform. From financing to value-added services to new opportunities, we are building a long-term ecosystem for MSMEs to grow and thrive with us as their partner.

Zal Group

Economic and enterprise development company with a focus on providing business support such as linkages to Market, Finance and Technical Services to MSMEs to foster private sector-led development in Nigeria.

If you missed previous sessions, visit this link>