Blog

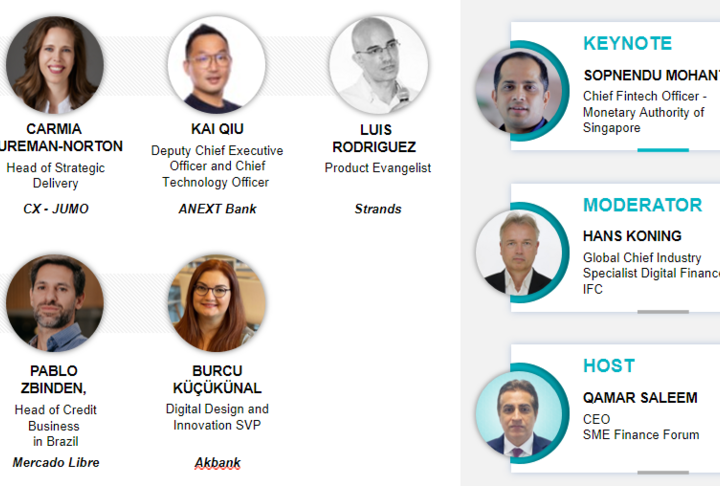

Banks and Fintech Companies Come Together to Discuss Vision 2030 for Small Business Finance

Micro, small and medium businesses worldwide have an unmet credit need of around 3 trillion USD. Lending to SMEs are deemed too risky and too high cost by traditional banks. The question is - How will tech-savvy millennials shape the financial services industry? Can banks innovate to fill the unmet credit needs of small businesses or will they be replaced by fintech companies?

This week leaders from the private and public sector gathered in Antalya, Turkey to discuss partnerships, innovations and disruptive technologies to accelerate small business finance. The SME Finance Forum, an initiative created by the G20 and managed by IFC, launched its global member network during the two-day conference. The inauguration ceremony was hosted by Queen Maxima of the Netherlands, Special Advocate for the Secretary General of the UN for Inclusive Finance for Development, and Cevdet Yılmaz, the Deputy PM of Turkey. The Forum’s founding members include banks, technology “disruptors”, regulators and development finance institutions from around the world committed to accelerating financing for small businesses.

“Our founding members are diverse in terms of the type of organization as well as their size and regional focus,” said SME Finance Forum CEO, Matthew Gamser. “However, they are all committed to share knowledge, spur innovation, and provide a new voice in policy discourse.”

There is no doubt that the landscape has changed for banks. They are increasingly catering to millennials, who are “digital natives”. At the same time, the digital revolution is lowering cost, distance, time and barriers to entry, creating space for new fintech players to enter the market. Sir Sherard Cowper-Coles, Group Head of Government Affairs at HSBC, pointed out that many banks are also investing heavily in technology and are transforming into fintech companies. Others were less optimistic about the future of banks. JP Nicols, CEO of Innosect, warned that banks may face their “Kodak moment” unless they embrace disruptive technologies. However, since banks are profiting from business-as-usual, there is little incentive for them to innovate and cannibalize their own business.

Governments also have a role to play in this emphasized Gloria Grandolini, Senior Director of Finance and Markets at the World Bank Group. They have the dual responsibility of creating a strong enabling environment where financial innovation can thrive, while providing oversight and protecting the interests of customers.

The SME Finance Forum provides a unique platform which brings together financial institutions, banks, donors and policy-makers. It is well-positioned to advance public-private dialogue and help ensure that small businesses can access the finance they need to thrive.