Blog

Business Information and Credit Risk in the Post-COVID-19 Era

Dec 03, 2020

A virtual roundtable summary

Since the COVID-19 pandemic, public entities have introduced various policies and programs to mitigate the economic disruption. However, the relief measures including moratoriums on loan repayments, closure of courts and banks due to lockdowns, increased lending to businesses under government-backed scheme, as well as changes in insolvency regimes have obstructed the flow of data within the credit information ecosystem. The unprecedented level of government intervention has potentially increased the information asymmetry between lenders and borrowers, resulting in unintended consequences for business information and subsequent credit risk decisions.

As part of the virtual roundtable series on COVID-19 mitigation efforts, the SME Finance Forum hosted a virtual roundtable with Neil Munroe (BIIA), Kaushal Sampat (Rubix Data Sciences), Salil Chugh (Experian), and Stephan Wolf (GLEIF), moderated by Khrystyna Kushnir (SME Finance Forum), to discuss how the government responses to the COVID-19 pandemic have impacted the accuracy and timeliness of information held by the business information industry both directly and indirectly. The panelists also suggested alternative solutions to help SME lenders access up-to-date information about their clients and markets to continue lending activities.

Neil Munroe started the session with demonstrating how some of the government mechanisms could possibly lead to a decline in the quantity and quality of business information. One of the key sources for the business information providers is the public sector. Business Information providers gather data from business registers, courts and insolvency regimes to generate reports and scores that are used by banks, trade credit providers, and credit insurers. However, the government interventions as a result of COVID -19 have disrupted this flow of information. For example, there are changes in legislations to help companies avoid insolvency, but this direct action has reduced the number of insolvencies and bankruptcies reported. Regarding corporate legal procedures, the delay and flexibility in holding statutory events have led to inaccuracy of data held on register. In addition, the moratorium or extension offered on filing returns and working from home orders have caused ageing of latest Information available on business registers.

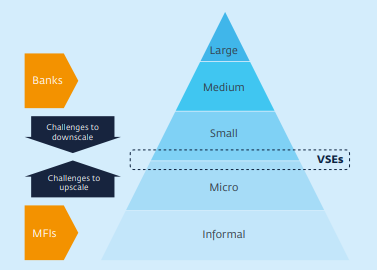

Kaushal Sampat focused on how the credit information companies and credit grantors have been influenced by the new norms. First of all, the extension in filing requirements and holding shareholder meetings will lead to a delay in the filing cycle for the previous financial year and out-of-date financial information for credit decisioning. The filing backlog and pileups at registries will potentially cause digital service issues, which makes data harder to access. The non-financial information, such as ownership change, will also be out-of-date. Secondly, defaults and delays in repayments are a critical parameter in credit scoring. The loan repayment deferrals and moratoriums can be misused by the businesses that are facing financial difficulties prior to the pandemic, causing issues for credit assessment and monitoring. It is hard for the credit information companies to identify those difficulties and may have a long-term effect in the industry. Thirdly, modifying insolvency norms also delays collection. Since the creditors are unable to enforce their claims, they may choose to limit their credit exposure, especially to the SMEs. The moratoriums might strain the already tight liquidity situations.

Despite the challenges that the business information industry is facing in the post-COVID times, there are certain alternative pathways for the SME lenders to access accurate and timely information about their clients. Salil Chugh demonstrates how Experian Asia Pacific is navigating the current situation to provide credit and information services. Firstly, the SME lenders should utilize tools, for instance, SME Risk Simulator Index, to carefully choose sectors where the investments are possible or to project the potential losses. Then, the lenders should examine alternate data sources to collect information regarding the operation of a company and its sustainability. The alternate data can be directly from the company, such as financial statements but also from third parties. For example, Experian provides SME network scores that encompasses early warning signals, buyers and supplier analysis, and proxy credit score. Based on data from various reliable channels, Experian has successfully established a robust SME credit assessment framework to support its clients with the decision-making processes.

Stephan Wolf explained how Legal Entity Identifier (LEI), endorsed by the G20, can play a critical role in today’s digital world. Connecting to key reference information, LEI provides organizations with unique, permanent identification of legal entities participating in financial transactions in the global market. For example, each LEI contains information about an entity’s ownership structure. The publicly available LEI data pool can be regarded as an international directory, which greatly enhances transparency. Expanding from Europe and North America, LEI has started to be adopted by the corporations in Africa and Asia. GLEIF has witnessed a rapid increase in the amount of LEI registrations especially in India and China over the past years. The foundation has been actively working with regulators and building private-public partnership in different countries to bring more companies to the global marketplace. The LEI database empowers the SME lenders with verifiable information to improve risk management and assessment of micro and macro prudential risks, which is paramount under the COVID-impacted context.

Lastly, the panelists encourage the business information industry and the SME lenders to consider and prepare for the long-term impact brought by the government interventions in the post-COVID-19 era. However, the market should not lose confidence but turn to the alternative solutions and sources to assess credit information and continue the lending activities.