Publications

Data Analytics

Apr 22, 2025

Digitalization accelerated by the pandemic has exponentially increased the number and variability of alternative data sources. The stay-at-home requirements during the pandemic forced several business models to be digitized. This helped spur the digitization that had been ongoing pre-pandemic, largely driven by governments as countries sought to...

Supply & Value Chain Finance

Apr 03, 2025

IFC and C2FO are working under a strategic partnership to bolster job growth and economic prosperity in emerging markets and developing economies. The first initiative will work to enhance financing for local enterprises in Africa by developing a specialized, web-based multinational working capital platform for micro, small, and medium enterprises...

Policy & Regulation

Apr 03, 2025

The OECD Financing SMEs and Entrepreneurs Scoreboard: 2025 Highlights tracks financing trends, conditions and policy developments across nearly 50 countries. The paper provides official data on SME financing from 2007 to 2023, with additional insights for 2024 and early 2025, covering debt, equity, asset-based finance and overall financing...

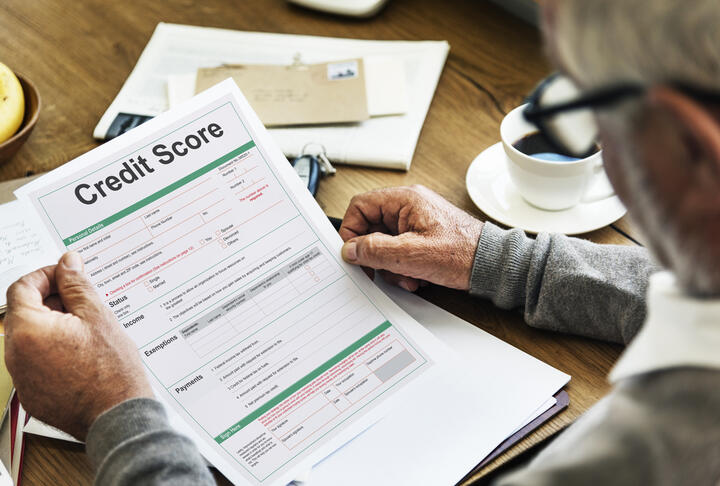

Credit Risk & Scoring

Mar 28, 2025

Since 2020, #VietNam has experienced a surge in nonperforming loans (NPLs). Not only does the growing number of NPLs reduce the stability of the banking system, but each one represents a borrower excluded from credit markets. Many of the NPLs are consumer debts, meaning poorer households are particularly hard hit. IFC - International Finance...

Mar 21, 2025

MSMEs employ more than 80% of the workforce in #Ghana and account for over 70% of GDP. The majority of these enterprises are informal, consisting mainly of micro and sole enterprises operated by women and young entrepreneurs. While these small businesses play a critical role in economic growth and job creation, lack of information and collateral...

Equity

Feb 11, 2025

Highlights • Inclusive credit fintech has the potential to address the estimated US$4.9 trillion global credit gap for micro and small enterprises (MSEs). • However, access to diverse and suitable funding sources remains a critical challenge, especially for early-stage fintechs that are not yet profitable. • This focus note explores financing...

Digital Financial Services

Feb 11, 2025

BII sees opportunities for impact in firms of all sizes. Sole-traders, microenterprises, small, medium, and large firms are all sometimes unable to find the financing they need, to the detriment of society. The growth of firms is at the heart of development. Countries escape poverty as people move out of informal employment into wage-paying jobs...

Alternative Financing

Guarantees

Feb 05, 2025

EXECUTIVE SUMMARY KEY ACTIONS AGREED BY THE EXPERT GROUP: shorted by importance and short term feasibility: Banking channel PUBLIC-PRIVATE SHARED INVESTMENT MODELS: Building on the success of initiatives like “France Relance,” this action advocates for collaborative investment strategies that engage both public and private sectors in financing...

Policy & Regulation

Feb 03, 2025

Summary The G20 Global Partnership for Financial Inclusion (GPFI) Action Plan for Micro, Small, and Medium enterprises (MSME) Financing is a call to action to intensify the efforts of G20 and willing non-G20 countries to close the financing gap for MSMEs. MSMEs represent a significant share of economic activity and capture a large share of...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Krishnamurthy Suresh (CCAF), Zhifu Xie (CCAF), Felipe Ferri de Camargo Paes (CCAF), Peter J Morgan (ADBI), Bryan Zhang (CCAF). This first edition of ‘The ASEAN Access to Digital Finance Study’, aims to provide valuable data and insights into how individual households, consumers, and micro, small and medium enterprise (MSME)...

Digital Financial Services

Feb 02, 2025

Tania Ziegler (CCAF), Felipe Ferri de Camargo Paes (CCAF), Cecilia López Closs (CCAF), Erika Soki (CCAF), Diego Herrera (IDB), Jaime Sarmiento (IDB) This edition of ‘The SME Access to Finance: A Deep Dive into LATAM’s Fintech Ecosystem’ provides insights into micro, small and medium enterprises’ (MSMEs’) access to funding through the alternative...

Digital Financial Services

Feb 02, 2025

By Krishnamurthy Suresh (Principal Researcher, CCAF), Felipe Ferri de Camargo Paes (Principal Researcher, CCAF), Loh Xiang Ru (CCAF), Richard Kithuka (CCAF), Peter Morgan (ADBI), Pavle Avramovic (CCAF), and Bryan Zhang (CCAF). This is the second edition of our ‘Access to Digital Finance’ study in Asia-Pacific. Building on our previous publication...

Data & Cybersecurity

Fintech

Dec 15, 2024

"International AI Policy Focuses on Safety" discusses the increasing global emphasis on ensuring the safe and responsible use of artificial intelligence (AI). Key points and main ideas include: International Collaboration on AI Safety: Governments and international organizations are recognizing the need for harmonized approaches to AI safety,...

Digital Transformation

Nov 27, 2024

November 2024 Highlights Open finance is a financial innovation that facilitates customer-permissioned access to and use of customer data held by financial institutions to provide new and enhanced services and develop innovative business models. Open finance frameworks can spur innovation, improve competition, enhance customer empowerment, and...

Digital Transformation

Fintech

Nov 05, 2024

A follow-up series of Banking for small and medium enterprises by IBM Institute for Business Value Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world’s workforce, and contributing 50% to global GDP.* Despite their significance, SMEs face many...

Digital Transformation

Oct 29, 2024

The white paper by Mastercard underscores the pivotal role of middle market businesses (firms with 50 to 250 employees) in driving global economic growth, with a notable $24.2 trillion in B2B spending in 2022. These businesses face unique challenges as they scale, such as the need for digitization, automation, and streamlined operations, along...

Sustainable Finance

Oct 20, 2024

As the world faces the urgent challenge of climate change, financial institutions, especially Public Development Banks (PDBs), are crucial in helping Small and Medium Enterprises (SMEs) transitioning to a low-carbon economy. This publication reviews the different solutions offered by 16 Public Development Banks (PDBs) to support the...

Fintech

Oct 20, 2024

October 2024 Highlights: Inclusive fintech startups are early-stage, venture-backed enterprises creating innovative credit products for microenterprises in emerging markets, which holds great promise for the future of microenterprise finance. In this note, we highlight strategies employed by fintech startups that benefit microenterprises via three...

Sustainable Finance

Oct 04, 2024

Mobilizing Investment for the Developing World's Sustainable Cooling Needs Rising global temperatures mean demand for cooling in homes, workplaces, and across supply chains is accelerating, particularly in developing economies where the impact of extreme heat is already being felt most acutely. Heat-related deaths are running at an annual average...

Financial Inclusion

Fintech

Oct 04, 2024

June 5, 2024 | Washington DC EMpact is helping build AI Labs within our partner organizations as a part of our effort to accelerate digital transformation of agricultural value chains and relevant financial services. Today, EMpact published a new white paper that delves into the pivotal role of Artificial Intelligence (AI) in propelling financial...

Data Analytics

Fintech

Oct 04, 2024

Small and medium enterprises face many challenges within a rapidly evolving economic landscape—one that demands innovative banking solutions. Small and medium-sized enterprises (SMEs) form the backbone of the global economy, representing 90% of all firms, employing approximately 70% of the world's workforce, and contributing 50% to global GDP. But...

Supply & Value Chain Finance

Jul 25, 2024

Supply Chain Financing (SCF) is becoming an increasingly common vertical within the banking industry. The global credit crisis of 2008 forced trade finance seekers to look for alternatives as liquidity in supply chains became a major concern for businesses. This spurred an increased demand for supply chain financing as businesses worked to...

Data & Cybersecurity

Digital Financial Services

Jul 15, 2024

AI Takes Center Stage: Survey Reveals Financial Industry’s Top Trends for 2024 The world’s leading financial services institutions spotlight where AI is providing the best return on investment. January 11, 2024 by Kevin Levitt The financial services industry is undergoing a significant transformation with the adoption of AI technologies. NVIDIA’s...

Jul 11, 2024

The recent McKinsey Global Institute report A microscope on small businesses: Spotting opportunities to boost productivity estimated that micro-, small, and medium-size enterprises (MSMEs) account for two-thirds of business employment in advanced economies— and almost four-fifths in emerging economies—as well as half of all value added.1 In this...

Data & Cybersecurity

Payments

May 07, 2024

Summary Focus Advances in digital technology have transformed people's lives in recent decades. But large swathes of the financial system are stuck in the past. Many transactions still take days to complete and rely on time-consuming clearing, messaging and settlement systems and physical paper trails. Improving the functioning of the financial...

Financial Inclusion

May 07, 2024

By Anu Madgavkar , Marco Piccitto , Olivia White , María Jesús Ramírez , Jan Mischke , and Kanmani Chockalingam MSMEs are vital for growth and jobs, but struggle with productivity. The route to higher productivity lies in creating a win-win economic fabric for all companies. At a glance Micro-, small, and medium-size enterprises (MSMEs) form the...

Digital Financial Services

Apr 15, 2024

Financial makers discuss how to reimagine banking with embedded finance solutions that deliver financial services whenever and wherever they’re needed. A new generation of financial thinkers and makers is reimagining the conventional bank. Empowered by technology and a youthful hunger for change, they’re determined to make banking easier, more...

Governance

Data & Cybersecurity

Apr 15, 2024

The game-changer: How generative AI can transform the banking and financial sectors The most essential question of the moment: how can AI help address and course-correct banks’ productivity and financial performance? Following the astonishing rise of generative AI, artificial intelligence has seized the world’s attention. Executives are either...

Digital Transformation

Apr 15, 2024

Access to affordable finance poses a persistent challenge for micro, small, and medium-sized enterprises (MSMEs) worldwide, inhibiting their potential growth and the economic development of countries that are reliant on these businesses. The rise of the digital economy has opened up new pathways for financing, but has also made digital...

Fintech

Payments

Apr 15, 2024

Summary: - Regional focus: the report foretells a surge in interest from fintechs towards SMEs in Latin America by 2024. - Innovation opportunities: it highlights the potential for innovation within the industry and identifies key areas where solutions can reshape the fintech landscape to better serve SMEs. - Targeted countries: discover which...

Gender Finance

Fintech

Mar 21, 2024

Fintech and digital financial services have been considered a game-changer for women's financial inclusion and economic empowerment. Until now, there has been limited research that quantifies the degree to which fintech firms are actively addressing women's financial inclusion and the specific strategies that are showing success. To fill this gap...

Financial Education

Financial Inclusion

Fintech

Feb 14, 2024

This paper investigates strategies of European microfinance institutions (MFIs) and inclusive FinTech organisations to address financial and digital illiteracy among vulnerable customers. It reveals that both MFIs and FinTech organisations focus on personalised financial education, training and coaching but adopt distinct strategies in their...

Sustainable Finance

Fintech

Feb 12, 2024

Slowing economic growth, rising inflation, and climbing interest rates are straining the business models for inclusive fintechs, creating significant uncertainty and new funding challenges. For the past four years, the Inclusive Fintech 50 (IF50) global innovation competition identified and elevated cutting-edge, emerging inclusive fintechs...

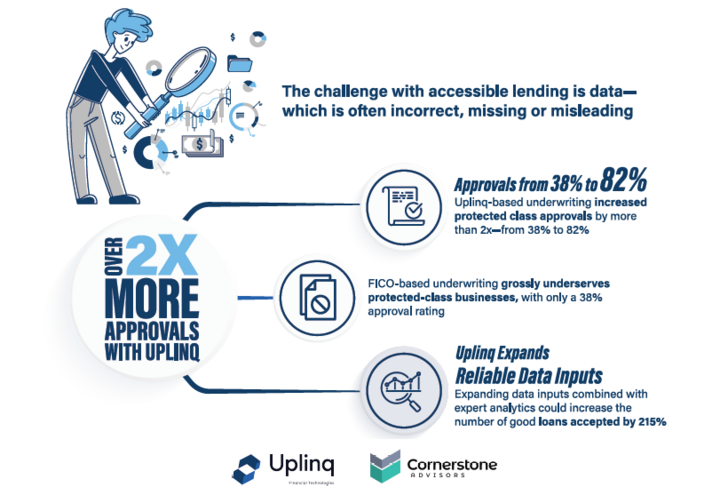

Alternative Financing

Feb 02, 2024

Uplinq Financial Technologies , the first global credit decisioning support platform for small business lenders, announced the publication of “ Fair and Accessible Credit for Small Businesses: A Guidebook for Financial Institutions ,” a white paper that blueprints how banks and credit unions can leverage AI technology and alternative data to...

Digital Transformation

Jan 23, 2024

With the rapid advancements in computational power, the decades-long vision of using and deploying artificial intelligence (AI) has become a reality. The technology’s swift development has allowed it to transform every walk of life, as it is a wide-ranging tool that enables people to rethink how to analyze data, integrate information and use the...

Financial Inclusion

Dec 22, 2023

The Inclusive Finance India Report provides a comprehensive review of the progress of financial inclusion in the country, tracking performance, highlighting achievements, and flagging gaps and issues that need to be addressed at the levels of both policy and practice. It is a much-awaited annual reference document for policymakers, investors,...

Sustainable Finance

Dec 01, 2023

Switching to greener technologies in construction and operation of buildings and materials, combined with more climate-friendly capital markets, could reduce the construction value chain’s carbon footprint 23 percent by 2035, while creating investment opportunities in emerging markets, according to a major report from the International Finance...

Sustainable Finance

Policy & Regulation

Nov 22, 2023

Addressing the climate crisis requires the net zero transition of millions of SMEs globally. SMEs have a significant aggregate environmental footprint and need to adopt cleaner business models. As eco-entrepreneurs and eco-innovators, they also have a key role to play in devising innovative climate solutions. Access to finance is essential for SME...

Financial Education

Financial Inclusion

Gender Finance

Supply & Value Chain Finance

Digital Transformation

Nov 02, 2023

Digitizing the MSME ecosystem through e-commerce, the gig economy, and digital MSME business services has an impact on the digital-transformation of small businesses. These digital advancements have reshaped the landscape for MSMEs and enabled new opportunities for growth and expansion. The rise of digitally enabled new solutions for MSMEs, such...

Supply & Value Chain Finance

Nov 01, 2023

With over EUR 300 billion financed to SMEs as well as to larger corporates, the global factoring and receivables finance Industry is is providing much needed liquidity to the heart of the economy to support economic growth, export and employment. How does the industry evolve and adapt to challenges such as fraud, changing regulations and ESG...

Policy & Regulation

Nov 01, 2023

The Recommendation on SME financing was adopted by the OECD Council meeting at Ministerial level on 8 June 2023 on the proposal of the Committee on SMEs and Entrepreneurship (CSMEE). The Recommendation aims to support Adherents in their efforts to enhance SME access to a diverse range of financing instruments. It supports the development of...

Financial Inclusion

Governance

Oct 24, 2023

The "OECD Financing SMEs and Entrepreneurs Scoreboard: 2023 Highlights" document SME and entrepreneurship financing trends, conditions and policy developments. The report provides official data on SME financing in close to 50 countries, including indicators on debt, equity, asset-based finance and financing conditions. Data for 2021 are...

Sustainable Finance

Payments

Oct 16, 2023

The B20 , Business at OECD (BIAC) and the International Organisation of Employers (IOE) released a joint paper, underlining the need to raise business productivity by effectively addressing the private sector’s working capital requirements. Released in the margins of the B20 India Summit, the three leading private sector organizations recommend to...

Financial Inclusion

Digital Financial Services

Digital Transformation

Sep 25, 2023

Background: The India G20 Presidency has prioritized the development of an open, inclusive and responsible digital financial ecosystem based on the presence of a sound and effective digital public infrastructure (DPI) for the advancement of financial inclusion and productivity gains. Builds on the work and achievements from previous presidencies...

Financial Inclusion

Policy & Regulation

Data Analytics

Sep 25, 2023

Small and Medium-sized Enterprises (SMEs) play a vital role in the global economy, yet they often face challenges due to limited access to financing. To address this issue, we propose the implementation of Prosperity Data Networks (PDNs), a cutting-edge tool that leverages Artificial Intelligence (AI). PDNs are AI-powered, community-controlled and...

Financial Education

Sustainable Finance

Sep 25, 2023

To help financial institutions to translate sustainable finance principles to the operations they have with MSMEs, IFC Green Bond Technical Assistance Program (GB-TAP) has developed the Sustainable MSME Finance Reference Guide. This first-of-its-kind Guide sets out a practical approach for financial institutions in emerging markets on how to...

Financial Inclusion

Operational Risk

May 22, 2023

The EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among General Partners on a pan-European level) provide an opportunity to retrieve unique market insights. This publication is based on the results of the 2022 waves of these two surveys and examines how the Russian offensive war against...

Digital Financial Services

Apr 24, 2023

Strands, a CRIF company, and PwC launched a report with an in-depth analysis on how customer habits, Open Finance and new players entering the financial services arena are revolutionizing the Digital Banking context. The Digital Banking context is shifting, as new players are entering the financial services arena and threatening the position of...

Financial Inclusion

Policy & Regulation

Digital Financial Services

Fintech

Payments

Mar 13, 2023

The Roadmap for Enhancing Cross-border Payments is a priority initiative of the G20. Much has been accomplished during its first two years, including agreement on a set of outcome targets endorsed by the G20 in October 2021. The work in 2021 and 2022 has focused on establishing the foundational elements of the Roadmap and beginning to pivot from...

Financial Inclusion

Gender Finance

Digital Financial Services

Fintech

Mar 06, 2023

This paper examines the role of Fintech in financial inclusion. Using Global Findex data and emerging fintech indicators, it finds that Fintech has a higher positive correlation with digital financial inclusion than traditional measures of financial inclusion. In the second stage of their empirical investigation, the authors examine the key...

Financial Inclusion

Equity

Gender Finance

Policy & Regulation

Mar 01, 2023

This working paper examines the current academic literature on access to finance for female entrepreneurs and female-led enterprises. It covers two main financing markets: credit and venture capital (VC). The paper finds wide consensus in the academic field that gender-related credit and VC gaps exist in Europe. It also collects some of the most...

Financial Inclusion

Feb 13, 2023

The COVID-19 pandemic has accelerated digital financial inclusion with increased digital financial services. According to the 2021 Global Findex Database, global account ownership has increased from 51% of the world’s population in 2011 to 76% in 2021. Notwithstanding the gains, about 25% are still outside the formal financial system. More robust...

Fintech

Jan 17, 2023

Nearly 500 million micro and small enterprises (MSEs) are estimated to be operating around the world. Access to credit and other financial services is critical to the growth and sustainability of these businesses, and consequentially to the low-income and vulnerable populations which rely on MSEs for their livelihoods. Yet despite decades of...

Financial Education

Aug 13, 2022

The EIF Business Angels Survey, together with the EIF VC Survey and the EIF Private Equity Mid-Market Survey (the largest combined regular survey exercises among GPs and Business Angels on a pan-European level) provide an opportunity to retrieve unique market insights. This publication is based on the results of the 2021/22 EIF Business Angels...

Financial Inclusion

Payments

Jul 25, 2022

In the coming years, real-time payments are set to increase exponentially and by 2026, are forecasted to account for 26% of the total electronic payments. With certain growth ahead, governing bodies and payment regulators play a crucial role in advancing their country's payment systems to create an ecosystem that unlocks economic growth and...

Rural & Agriculture Finance

Mar 29, 2022

This report takes stock of the increasingly pluralistic landscape of agricultural small- and medium-sized enterprise (agri-SME) finance in sub-Saharan Africa and Southeast Asia, with the aim to establish a new perspective on the market overall - sizing and segmenting the market in new ways, reflecting on the rapidly accelerating imperative around...

Credit Risk & Scoring

Mar 24, 2022

Latest Banking Circle white paper examines pain points faced by banks and FinTechs as a result of de-risking strategies According to new research commissioned by Payments Bank, Banking Circle, big bank de-risking is significantly hampering the efforts of many Financial Institutions to deliver services that empower financial inclusion. The root...

Alternative Financing

Guarantees

Mar 01, 2022

Asset Finance is evolving rapidly, and many legacy systems are failing to keep up with the changing needs of providers and their customers. Read about: A comprehensive overhaul of contract management The connected contract management system (CMS) Better experiences, inside and out New standards of efficiency Download HPD Lendscape new white paper...

Fintech

Payments

Feb 22, 2022

The evolution of digital money is taking hold, as policymakers and central bankers explore the idea of government-backed assets on blockchain called Central Bank Digital Currency, or CBDCs. More than 90 countries are either researching or developing CBDCs. Many see the direct advantages for their citizens and economies: decreased dependence on...

Sustainable Finance

Governance

Feb 01, 2022

Blue Finance is an emerging area in Climate Finance with increased interest from investors, financial institutions, and issuers globally. It offers tremendous opportunities and helps address pressing challenges by contributing to economic growth, improved livelihood, and the health of marine ecosystems. The ocean economy is expected to double to $...

Equity

Jan 31, 2022

Saudi Venture Capital Company (SVC) is a Government VC established in 2018 by Monshaat as part of the Financial Sector Development Program (FSDP) to stimulate venture investments by investing in funds as well as co-investing with angel groups for the primary goal of minimizing financing gaps for startups and SMEs by investing SAR 2.8 Billion ($750...

Financial Education

Non Financial Services

Jan 27, 2022

As the world works towards food system transformation, the role of various stakeholders serving small farmers and agri-SMEs has gained increasing importance. The market of business development services (BDS) for agri-SMEs has grown significantly in the last decade, with more organizations providing technical, financial, and capacity-building...

Financial Inclusion

Data Analytics

Payments

Jan 27, 2022

Biometrics technology can enhance the convenience and security of digital payments, and many observers have pointed to the potential benefits of using it to advance financial inclusion. This paper analyses how, and under what conditions, biometrics can facilitate financial and digital inclusion for lower income and unbanked populations and...

Alternative Financing

Covid-19

Jan 26, 2022

This publication "Receivables Finance: The Voice of the Industry", prepared by member HDP Lendscape , one of the world’s leading software providers for Asset Based Finance (ABF), dives into the following challenges and opportunities on the minds of industry leaders: Pandemic recovery New lending propositions and the rise of independents The...

Covid-19

Jan 24, 2022

The current crisis has put a spotlight on workout frameworks, especially out-of-court or hybrid procedures, which can provide flexible and cost-effective solutions to address firms’ liquidity and solvency issues while reducing the burden on courts. Some countries implemented reforms to their corporate workout frameworks in the wake of the COVID-19...

Financial Inclusion

Policy & Regulation

Digital Transformation

Jan 20, 2022

This reading deck describes three regulatory approaches used by policy-makers to regulate digital banks. It has a focus on harnessing the potential of digital banks to bring welcome competition and innovation to the banking sector and advance financial inclusion. It will help policy makers, especially in emerging markets and developing economies,...

Digital Transformation

Payments

Jan 19, 2022

A review of literature on digital payments’ impact on micro and small businesses reveals how digitalization is changing this segment, and why understanding this transition is key to inform effective public and private strategies and investments to accelerate the success of the small business sector as a whole. Read more about new strategies for...

Covid-19

Digital Transformation

Fintech

Nov 24, 2021

The intensity of the COVID-19 shock has clearly varied among MSMEs. On a more positive note, the COVID-19 crisis has accelerated the digitalization of many MSMEs and fostered their participation in digital ecosystems and marketplaces. In response to the emergency, governments have quickly introduced a wide range of policy and regulatory measures...

Gender Finance

Aug 09, 2021

Across the globe, e-commerce is thriving. The e-commerce market in Africa is expected to reach $84 billion by 2030. The number of online shoppers has increased by an average of 18 percent every year since 2014, with similar growth anticipated over the next decade. The IFC’s latest report Women and E-commerce in Africa is the first large-scale use...

May 07, 2021

In this publication, you will read about the SME Finance Forum highlights in 2020. Extract from the Foreword: The year 2020 has been a challenging one for all of us. We have seen the COVID-19 pandemic throw the world into uncertainty. In this context, we are proud to have launched new services to help our members deal with this extraordinary...

Policy & Regulation

Covid-19

Feb 23, 2021

EIF Working Paper 2021/071: EIF Venture Capital, Private Equity Mid-Market & Business Angels Surveys 2020: Market sentiment – COVID-19 impact – Policy measures 2020 was an unprecedented and remarkable year, and also a year with high uncertainty and increased information needs. The EIF VC Survey, the EIF Private Equity Mid-Market Survey, and...

Digital Financial Services

Fintech

Jan 26, 2021

Jobs to Be Done and cultural insights on what business owners need and the digital services that will help them meet their goal. What you will learn from that report: The entrepreneurial mindset and inspirations The growth opportunity in the SMB market How to design truly digital services for SMBs How to create cultural relevant financial brands...

Supply & Value Chain Finance

Jan 21, 2021

Micro-, small-, and medium-sized enterprises (MSMEs) face significant challenges in obtaining the financing and other resources they need to thrive. IFC, as a member of the World Bank Group, is committed to supporting these businesses by mobilizing private and public sector stakeholders to expand financial inclusion. Digital integration of “...

Covid-19

Jan 20, 2021

Sub-Saharan Africa was hit hard by the COVID-19 shock in 2020, experiencing the first recession in roughly thirty years. However, the impact of the public health crisis and pandemic-induced global recession has been less severe than in-itially feared, and weaker than in other EM regions. This is the result of commodity prices recovering faster...

Policy & Regulation

Credit Risk & Scoring

Jan 12, 2021

In recent years, as more and more regulators have begun to assume the role of supervision and oversight over credit bureau(s), the World Bank Group has supported supervisors in understanding and carrying out their duties as it relates to this role. The WBG has supported the development of the credit bureau supervisory framework and the capacity to...

Policy & Regulation

Credit Risk & Scoring

Jan 08, 2021

Coordination between secured transactions law and rules regulating financial products and institutions is of primary importance to support establishing a sound and inclusive credit ecosystem. This Primer illustrates why coordination between secured transactions law reforms and prudential regulation is needed; introduces the rationale and key...

Non Financial Services

Jan 06, 2021

After a busy year, working with thousands of entrepreneurs across Africa in our ‘new world’, the African Management Institue (AMI) has been thinking deeply about the future of business development support, and how the crisis brought about by Covid-19 might in fact open up new opportunities to serve more SMEs, more effectively. Their new report – ‘...

Guarantees

Jan 01, 2021

Lending based on movable assets is much more common in developed markets. Through the work of the World Bank Group and the International Finance Corporation, the use of lending based on movable assets continues to expand throughout the globe. Many best-practice examples can now be found in emerging markets such as Mexico, Colombia, Peru, Vietnam,...

Non Financial Services

Policy & Regulation

Dec 06, 2020

IFC had a strong year in spite of the pandemic. They committed $22 billion in long-term finance—an almost 15 percent year-on-year increase—including $11.1 billion invested for their own account. In addition, short-term financing commitments, including trade finance, totaled $6.5 billion: a 12 percent increase compared with the previous fiscal year...

Financial Education

Dec 04, 2020

To celebrate the new decade, this year’s Global SME Finance Forum looked much farther forward, to imagine where we might be in SME financing a decade from now. We tested the limits of our prescience by predicting how products, delivery channels, institutions and enabling environments might look 10 years from now. Following our practice of...

Islamic Banking

Nov 24, 2020

We are proud to share our member Islamic Corporation for the Development’s (ICD) Business Resilience Assistance for Value-adding Enterprise (BRAVE) project. ICD’s Industry and Business Environment Support (IBES) team initiated the BRAVE concept. The project was designed through joint efforts between ICD and the Small and Micro Enterprise Promotion...

Financial Inclusion

Nov 18, 2020

The Development Research Group at World Bank organized a talk on Bank lending for inclusive growth on November 17th, 2020 with speakers Claudia Ruiz-Ortega and Mario Guadamillas. You can watch the session recording HERE. Session Brief Bank lending is a key driver of economic growth. However, large inefficiencies remain—particularly in developing...

Gender Finance

Nov 09, 2020

We are delighted to share the ‘How to Invest With A Gender Lens?’, a guide created by Value for Women . The guide offers multiple concrete pathways for investors who want to keep inclusion at the core of their efforts in these important times of Covid-19 pandemic. Gender lens investing is the deliberate incorporation of gender factors into...

Trade Finance

Nov 06, 2020

The global economy is going through unprecedented times. The COVID-19 pandemic has shaken the world, threatening the lives and livelihoods of millions of people in both developed and developing economies, with a particularly devastating impact on small businesses. World trade plummeted in the first half the year, and despite signs of trade...

Trade Finance

Nov 02, 2020

We are delighted to launch the ‘Trade Finance Explained: An SME Guide for Importers and Exporters’ along with the Federation of Small Businesses (FSB), The Institute of Export & International Trade (IOE&IT), International Trade Centre (ITC), Forum of Private Business (FPB), and Trade Finance Global (TFG). What's the SME Trade Finance Guide...

Credit Risk & Scoring

Oct 15, 2020

The importance of credit reporting systems to the global financial system has been increasing over time. Robust credit reporting systems can promote not only access to affordable and sustainable credit for individuals and companies but also financial stability and economic growth. Credit reporting service providers (CRSPs) have been at the...

Credit Risk & Scoring

Oct 15, 2020

The main objective of this Knowledge Guide is to provide guidance to the World Bank Group (WBG) staff, donor institutions, government officials and other practitioners on the objectives and implementation of secured transactions reforms, as well as the factors that affect the implementation. The Knowledge Guide considers the experiences learned in...

Gender Finance

Oct 06, 2020

IFC and member FMO - Dutch entrepreneurial development bank has launched a report today on how non-financial services are the key to unlocking the growth potential of women-led businesses. The report highlights how women SME such as Patricia Mwangi’s business in Kenya benefit from non-financial services. Download the report> http://wrld.bg/...

Covid-19

Sep 29, 2020

The treatment of credit data during a crisis has potential impact on the integrity of the credit reporting system and ultimately the financial markets. Inadequate and untimely data reduces the reliance placed by credit providers on the credit reporting system and can lead to credit rationing, increase in the cost of credit and exclusion of...

Credit Risk & Scoring

Sep 24, 2020

This third edition of the Credit Reporting Knowledge Guide, like the two earlier editions, disseminates knowledge on best practices in credit reporting development, based on the experiences of the World Bank Group. Since the launch of the program, the World Bank Group has helped to develop favorable credit reporting environments in many countries...

Youth Entrepreneurship

Sep 14, 2020

Four in 10 people, or 42 percent, of the world’s population are under the age of 25. Globally, an estimated 70.9 million youth were unemployed in 2017. Thus, job creation and economic growth through private sector development have become primary areas of focus for policymakers around the world. As more youth enter the workforce, they are known to...

Covid-19

Sep 11, 2020

B20 and Business at OECD launch “GVC Passport” concept on Financial Compliance to Reinvigorate Firms’ Growth Post-COVID-19 The Business 20 (B20), the official voice of the global business community across G20 members, and Business at OECD launched a joint conceptual policy proposal that focuses on reducing barriers that firms encounter in their...

Aug 28, 2020

Member EIF has issued two working papers as a result of a research project on “Measuring Microfinance Impact in the EU. Policy recommendations for Financial and Social Inclusion” (MeMI). The project was initiated and supervised by the EIF and was funded by the EIB Institute under the EIB-University Sponsorship Programme (EIBURS). The aim of this...

Aug 24, 2020

[REPORT LAUNCH] As part of the GPFI implementing partners, the United Nations Task Force on Digital Financing on the Sustainable Development Goals has launched the report: “People’s Money: Harnessing Digitalization to Finance a Sustainable Future”. New York City, 26 August - A new report launched today, “People’s Money: Harnessing Digitalization...

Jul 30, 2020

This publication is a research paper prepared by Dr. Randa Al-Yafi, Ph.D (Associates Professor) at College of Business Administration, Management Department, King Saud University, in Riyadh, Saudi Arabia (reviewed and approved by Kafalah GD). The research is showing some backgrounds of the SME sector and highlighting Kafalah role and achievements...

Gender Finance

Jul 28, 2020

Digital financial services have expanded opportunities for millions of women across the globe. More than 240 million more women now have an account with a financial institution or mobile money service, compared to 2014.1 Through this increased engagement in the formal economy, women’s resilience to financial, economic and health shocks is...

Digital Financial Services

Jul 22, 2020

Access to finance is a critical barrier for SMEs to start, sustain and grow their businesses. About half of formal SMEs do not have access to formal credit, and instead rely on internal funds, or cash from friends and family, to launch and initially run their business. An extensive survey of SMEs in 135 countries showed that access to finance was...

Gender Finance

Youth Entrepreneurship

Digital Financial Services

Jul 19, 2020

The G20 High-Level Policy Guidelines on Digital Financial Inclusion for Youth, Women, and SMEs document was produced by the G20 Global Partnership for Financial Inclusion (GPFI) in 2020 under the Saudi Arabia G20 Presidency with the support of OECD , the World Bank Group in partnership with The Better Than Cash Alliance, the Women's World Banking...

Covid-19

Jul 08, 2020

In this white paper, Dr. Mohammad Nurunnabi, Dr. Hisham Mohammed Alhawal and Professor Zahirul Hoque, from Global SME Policy Network (GSPN), address the impact of COVID-19 and how CEOs respond to SMEs recovery planning in Saudi Arabia. The findings of this study will be useful to global SMEs and policymakers and practitioners by providing examples...

Covid-19

Jul 07, 2020

Member Kabbage published a recent report on the results of the Paycheck Protection Program (PPP). The combined Kabbage Program processed more than $5.8 billion in Paycheck Protection Program loans, providing support to more than 209,000 small businesses and maintained an estimated 782,000 jobs across Main Street America. This includes all types of...

Digital Financial Services

Jul 03, 2020

The International Council for Small Business (ICSB), in June 2016, convened a small business panel at its 61st World Congress at the United Nations, in New York City. This report is the continuation of the ICSB’s work since 2016 with the goal of bringing all stakeholders and partners together in one place, with one mission, and one focus: to help...

Supply & Value Chain Finance

Jun 30, 2020

The FCI Annual Review has been recently published by our industry partner, and it is a globally recognised publication in the world of Factoring and Receivables Finance. Peter Mulroy, FCI Secretary General, introduces the publication highlighting the major achievements in 2019 but also the challenges and opportunities facing FCI and the industry...

Covid-19

Jun 16, 2020

The novel Coronavirus (SARS-CoV-2), which causes the Coronavirus disease (COVID-19) has infected over 7.45 million people worldwide and claimed over 400,000 lives globally. It is not just a pandemic—it is also a burgeoning (global) economic crisis, especially because of the measures (including lockdowns) adopted to contain its spread. Several...

Gender Finance

Covid-19

May 29, 2020

This evaluation report highlights an exhaustive situation of what Nigerien businesses are going through in general and more particularly those grouped within "emerging women" in particular since the COVID-19 was declared in late March in Niger. It is a real question of survival that is played out for these companies confronted as highlighted by...

Covid-19

May 21, 2020

The COVID-19 pandemic has so far spared Africa in terms of reported cases and casualties, yet the lockdowns in place have significantly hurt African economies. awamo , a digital, mobile banking platform, and credit bureau, specially designed for MFIs, has analyzed real-time transaction data of rural and semi-urban microfinance institutions from...

Gender Finance

Youth Entrepreneurship

Apr 20, 2020

The GPFI’s stocktaking of data available on financing for SMEs, both at the country level and at the client level of the major international development finance institutions, reveals serious gaps. Annual aggregate data is captured annually for only a minority of the world’s countries by the IMF, OECD, and others. Little if any data is available at...

Covid-19

Apr 17, 2020

In this unprecedented time of disruption to businesses, the World Bank launched, together with INSOL Intl, the Global Guide to Measures Adopted in Support of Distressed Businesses through the COVID-19 Crisis. Read more in these Guidance Notes: COVID-19 Outbreak: Capital Markets Implications and Response COVID-19 Outbreak: Insurance Implications...

Covid-19

Apr 13, 2020

In this recent COVID-19 Notes prepared by the World Bank and IFC, contributed by Ghada Teima , Global Lead Financial Sector Specialist at IFC, you will read an assessment on the impact and policy responses in support of private-sector firms in the context of the pandemic. Summary While a COVID-19 outbreak will have a generalized impact on business...

Financial Education

Apr 03, 2020

In this publication, you will read about the SME Finance Forum highlights in 2019. Extract from the Foreword: The year 2019 has been a remarkable year for the SME Finance Forum — a year of continued, strong membership growth and effective delivery of member services. Since our launch in November 2015, we’ve grown from a few dozen committed early...

Guarantees

Mar 02, 2020

This report, prepared by the World Bank , seeks to enhance practitioners’ understanding of the potential role that capital markets can have in SME financing in EMDEs. The report reviews global experiences with the use of capital markets solutions and, more generally, of market-based solutions to expand SME financing with a view to identifying key...

Feb 11, 2020

The future of financial services will be impacted deeply by the emergence of embedded finance: finance that promises to be more internet-like, more interconnected and more customizable, with novel components that can be inserted into individual businesses in different sectors. Read more about it in this white paper called Embedded Finance: The...

Equity

Feb 04, 2020

The EIF Working Paper 2020/062: The Business Angel portfolio under the European Angels Fund: An empirical analysis. This working paper, from member EIF, analyses the Business Angel (BA) portfolio of the European Angels Fund (EAF), which is an initiative of the European Investment Fund and engages in co-investment relationships with experienced...

Trade Finance

Jan 27, 2020

A “Thought-Starter” Contribution on Trade Finance to the 2020 G20 Process On the occasion of the Saudi B20 Inception event, a new Business at OECD report released (available here ) highlights that trade finance, key to business trust in global trade activities, is a case in point for the need to make additional efforts to tackle regulatory...

Credit Risk & Scoring

Fintech

Jan 14, 2020

This note analyzes the evolution of Credit Information Systems, including the emergence of new technologies that use alternative data in credit decisioning and the opportunities and risks associated with these trends. This paper also predicts the potential development effect of these disruptive technologies and proposes a role for the World Bank...

Policy & Regulation

Dec 23, 2019

The Doing Business 2020 study, by the World Bank Group, shows that developing economies are catching up with developed economies in ease of doing business. This publication is the 17th in a series of annual studies investigating the regulations that enhance business activity and those that constrain it. Doing Business presents quantitative...

Policy & Regulation

Dec 10, 2019

The Financial Stability Board (FSB) published its final report on the Evaluation of the effects of financial regulatory reforms on small and medium-sized enterprise (SME) financing , following a public consultation earlier this year. The evaluation is motivated by the need to better understand the effects of the reforms on the financing of real...

Digital Transformation

Dec 03, 2019

Learn in this publication how member 4G Capital use machine learning technology to provide scalable credit services for individual clients in Kenya, where the MSME finance gap is over $19 bn, making it the largest in Eastern Africa. They were able to measure the impact of their working capital credit, and they saw customers increase their revenue...

Policy & Regulation

Nov 06, 2019

This report is jointly produced by the World Bank and the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School. This study intends to understand the global regulatory landscape for alternative finance through the collation of empirical data from regulators, including securities regulators, capital markets...

Credit Risk & Scoring

Nov 05, 2019

IFC conducted the global SME Banking survey to better understand the challenges and trends SME banking operations experience in serving the small business segment in their countries. More than 110 SME Banking practitioners and leaders from around the world participated in the survey. The online survey launched in 2018 posed questions to understand...

Credit Risk & Scoring

Oct 22, 2019

The present study, presented in Brussels, analyses whether sharing more comprehensive data improves the functioning of credit markets in European countries. Assuming that mechanisms to share data do exist, does a higher comprehensiveness in the data collected matter for credit markets? The study answers this by firstly analysing whether higher...

Non Financial Services

Oct 21, 2019

This study of the Japanese model about the development of the Credit Guarantee System provides an in-depth analysis of the credit guarantee system behind the rise and sustainment of Japan’s economy, and explains how it can benefit Turkey. It outlines the credit guarantee system in Japan, which, in view of the author, the General Manager of SME...

Digital Financial Services

Oct 18, 2019

Youxin Financial provides personal financial services to customers around the world. The company is committed to using financial technology to provide innovative and financing solutions for micro and small businesses across China and contribute to the development of the real economy. In this publication, Youxin Financial shares an analysis of...

Non Financial Services

Oct 18, 2019

This Small Business Spotlight report by FinRegLab provides an overview of applied research based on data from six non-bank financial services providers, two of which are SME FInance Forum 's members — Accion , Kabbage , Brigit, LendUp, Oportun, and Petal—that have begun using cash-flow variables and scores in a bid to increase the provision of...

Financial Education

Oct 17, 2019

This report, by the International Council for Small Business (ICSB) and the International Labour Organization (ILO) , examines worldwide evidence of the contribution that the selfemployed and enterprises of different size classes make to total employment. A key finding is that, globally, the self-employed and micro- and small enterprises account...

Non Financial Services

Oct 17, 2019

This Guidebook , prepared by IFC , addresses the challenges and opportunities faced by SMEs at the various stages of their lifecycles, offering tailored corporate governance recommendations. It includes the Action Planning Tool to help SME owners, investors, and managers take a pragmatic approach to governance, as a means of strengthening their...

Gender Finance

Aug 19, 2019

According to a World Bank report “Profiting from Parity : Unlocking the Potential of Women's Business in Africa,” launched last March, women entrepreneurs make or are obliged to make different decisions than men because of gender-specific constraints. As a result, the report notes that, on average, women-owned firms post profits that are 34 %...

Aug 12, 2019

Credit Scoring in Financial Inclusion: How to use advanced analytics to build credit-scoring models that increase access. This guide emphasizes that the effectiveness of data analytics approaches often involves building a broader data-driven corporate culture. Publication by CGAP.

Payments

Aug 02, 2019

The new IMF series "Fintech Notes" examines pressing topics in the digital economy. The Rise of Digital Money analyses how technology companies are stepping up competition to large banks and credit card companies. Digital forms of money are increasingly in the wallets of consumers as well as in the minds of policymakers. Cash and bank deposits are...

Credit Risk & Scoring

Jul 29, 2019

The Empirical Research Findings report provides a detailed summary of our applied research based on data from six non-bank financial services providers, two of which are SME Finance Forum's members – Accion , Kabbage , Brigit, LendUp, Oportun, and Petal – that have begun using cash-flow variables and scores in an effort to increase the provision...

Digital Transformation

Jul 29, 2019

In recent years, Latin America has joined the worldwide Fintech revolution, creating innovation and start-up ecosystems that permit the development of new technology start-ups offering highly innovative products and financial services. Many studies have reflected the fervor currently felt in the Fintech sector in the Latin America and the...

Financial Education

Gender Finance

Jul 26, 2019

This year, the Group of Seven (G7) outlined an agenda to fight inequality. As part of this agenda, the G7 Partnership for Women’s Digital Financial Inclusion in Africa will support African governments, central banks, and financial institutions in their efforts to build more inclusive, sustainable, and responsible digital financial systems,...

Credit Risk & Scoring

Jul 24, 2019

The European Banking Authority (EBA) published the findings of its analysis on the regulatory framework applicable to FinTech firms when accessing the market. The Report illustrates the developments on the regulatory perimeter across the EU, the regulatory status of FinTech firms, and the approaches followed by competent authorities when granting...

Credit Risk & Scoring

Jul 23, 2019

Published annually, this report, in its 8th edition, documents trends in access to different types of finance for SMEs and entrepreneurs, financing conditions and government policy initiatives in this area. It was prepared by Kris Boschmans and Lora Pissareva, Policy Analysts, OECD Centre for Entrepreneurship, SMEs, Regions and Cities, SME and...

Digital Transformation

Jul 16, 2019

This research, by The Mastercard Foundation Partnership for Finance in a Digital Africa, collected information from 27 micro-entrepreneurs in Kenya about how they use platforms (from social media sites to ecommerce marketplaces and online freelancing websites) in their day-to-day business. The platform practices these conversations revealed...

Non Financial Services

Sustainable Finance

Digital Transformation

Jun 25, 2019

Blockchain has the potential to impact many industries, including financial services, so the Boston Fed sought to understand its foundational technology with first-hand research. They wanted practical experience, the kind only trial and error can bring. “Beyond Theory: Getting Practical With Blockchain” goes beyond the basics of distributed ledger...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Financial Services

Digital Transformation

Mar 18, 2019

Capgemini and LinkedIn, in collaboration with Efma, developed the World FinTech Report 2018 based on a global survey encompassing responses from traditional financial services firms and FinTech firms including banking and lending, payments and transfers, investment management, and insurance. Questions sought to yield perspectives from both FinTech...

Financial Education

Non Financial Services

Supply & Value Chain Finance

Mar 01, 2019

Remarkably, a small fraction of firms account for most of the job and output creation in high-income and developing countries alike. Does this imply that the path to enabling more economic dynamism lies in selectively targeting high-potential firms? Or would pursuing broad-based reforms that minimize distortions be more effective? Inspired by...

Financial Education

Gender Finance

Rural & Agriculture Finance

Youth Entrepreneurship

Feb 27, 2019

Open data is data that is made available for anyone to access, use and share. With more access to open data, people can help shape a more sustainable future with evidence-based solutions, contributing at the same time to a more transparent decision-making. But to reach the full potential of open data, it must be available to and used by all. Read...

Financial Education

Gender Finance

Governance

Policy & Regulation

Jan 28, 2019

This state of practice report identifies and describes 74 government initiatives in the Savings Group sector across 20 countries in Sub-Saharan Africa – related to financial inclusion, social protection, women’s empowerment, and sector regulation and coordination. The purpose of the report is to support the further development of public policy and...

Financial Education

Supply & Value Chain Finance

Youth Entrepreneurship

Payments

Dec 14, 2018

Here is one of three Field Notes from the Partnership for Financial Inclusion, a joint initiative of IFC and the Mastercard Foundation, to help DFS providers to tailor products and services to particular market segments as they shed new light on two particular market segments, youth and women, as well as the potential for digitizing social...

Non Financial Services

Gender Finance

Governance

Oct 23, 2018

A continuation of MicroSave’s research on developing financial services for women was released this month. The publication details areas such as, microfinance, digital financial services, direct benefit transfers, MSMEs and agent networks. Information surrounding what financial service providers (FSPs) lack notice of when creating financial...

Non Financial Services

Gender Finance

Supply & Value Chain Finance

Policy & Regulation

Credit Risk & Scoring

Sep 11, 2018

The Future of Business Survey in collaboration with Member World Bank, Facebook and OECD provides monthly data on the economic environment for SMEs around the world. Key findings in the publication included: In nearly every country and region, women report using bank loans less frequently than men do, instead relying on personal savings and...

Credit Risk & Scoring

Sep 05, 2018

Lack of credit data is one of the major obstacles to individuals and MSMEs financing in developing countries. Despite the insufficient credit data, MSMEs and individuals generate vast amounts of non-credit digitized data daily. MSMEs and individuals are leaving vast digital footprints and data trails on mobile and online payments platforms, social...

Supply & Value Chain Finance

Credit Risk & Scoring

Payments

May 02, 2018

The ABA survey was conducted to review the digital lending landscape, specifically to gauge member interest in two different types of business models: Technology partnership—Implementing digital lending technologies to offer a digital customer experience to originate, underwrite to bank guidelines, and close small business and consumer loans...

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Transformation

Apr 06, 2018

Digital lending can be a powerful force for financial inclusion. Innovations in digital lending are enabling financial service providers (FSPs) to offer better products to more underserved clients in faster, more cost-efficient, and engaging ways. Governments are increasingly incentivizing the growth of digital lending models as a way to promote...

Financial Education

Policy & Regulation

Credit Risk & Scoring

Feb 14, 2018

A joint report by IFC and the SME Finance Forum, has found that 65 million enterprises, or 40 percent of formal micro, small and medium enterprises (MSME) in developing countries, have an unmet finance need of $5.2 trillion a year. This gap is larger than previously estimated. The results were presented at the Global SME Finance Forum held in...

Financial Education

Islamic Banking

Feb 05, 2018

This PPIAF-funded report aims to discuss and disseminate information on how Islamic finance has been applied in infrastructure projects through PPP schemes, what the structural challenges and solutions are, and what can be done to deepen and maximize the use of Islamic finance for this purpose. This report has two broad dimensions. The first is to...

Financial Education

Non Financial Services

Gender Finance

Supply & Value Chain Finance

Dec 01, 2017

Oxford University’s Linda Scott, Emeritus DP World Professor for Entrepreneurship and Innovation at Said Business School has launched The Global Business Coalition for Women’s Economic Empowerment (GBC4WEE) initiative, with a document that brings together her perspective of the collective learning of nine companies engaged in women’s economic...

Supply & Value Chain Finance

Credit Risk & Scoring

Nov 30, 2017

Demand for credit increased in central, eastern and south-eastern Europe (CESEE) in the six months to September 2017 and supply conditions eased, according to the latest Bank Lending Survey (BLS) produced by the Vienna Initiative. Across the client spectrum, supply conditions eased partially in the corporate segment, including SME lending, while...

Financial Education

Supply & Value Chain Finance

Policy & Regulation

Oct 05, 2017

New research by the Centre for Economics and Business Research (Cebr) and Hampshire Trust Bank, predicts that SME contributions to the UK economy will grow by 19 percent from 2016 to 2025. In 2016, SME employment across ten cities considered in the report were around 3.9 million. In 2025, the researchers expect the number to increase by one...

Financial Education

Non Financial Services

Credit Risk & Scoring

Sep 22, 2017

Small and Medium-Sized enterprises (SMEs) make up a large majority of businesses globally and play a crucial role in global economic development through job creation, economic growth, and innovation. For the health of the global economy, it is imperative that they have access to the needed credit to grow and expand. Credit infrastructure remains...

Policy & Regulation

Aug 29, 2017

The Associated Chinese Chambers of Commerce and Industry (ACCCIM)’s SME Survey Report 2017 aims at identifying the current SMEs challenges in Malaysia. The survey says that government is actively fostering SMEs in access to finance through provision of credit guarantees and also increasingly paying attention to financing SMEs by introducing new...

Sustainable Finance

Payments

Aug 28, 2017

Jessie Cheng is deputy general counsel at Ripple, a SME Finance Forum member, coauthors a Business Law Today article about the legality around payments for customers and businesses alike. The authors explain the legal framework for payments including the payment-system laws and customer-protection laws. Three examples are provided, such as person-...

Fintech

Jun 12, 2017

Digital finance, using alternative data, offers an extraordinary opportunity for expanding access to finance for small businesses. Every time small businesses and their customers use cloud-based services, conduct banking transactions, make or accept digital payments, browse the internet, use their mobile phones, engage in social media, buy or sell...

Financial Education

Credit Risk & Scoring

Apr 07, 2017

Hosted by the German Presidency on February 24, the G20 workshop “Helping SMEs Go Global - Moving Forward in SME Finance“, brought together more than 150 experts from G20 countries, development finance institutions, and the private sector to discuss issues related to advancing financial inclusion for small and medium-sized enterprises (SMEs)...

Policy & Regulation

Apr 04, 2017

Consistent with the theme of Germany's G20 Presidency in 2017, "Shaping an interconnected world", the GPFI SME Finance Subgroup will work on the implementation of the following priorities in 2017: Review and update of the G20 Financial Inclusion Action Plan; Roll out of the G20 Implementation Framework on SME financing; Financial Services for SMEs...

Gender Finance

Mar 08, 2017

GBA’s Women’s Market Analytics Survey is the only repository of banking data measuring the performance of financial institutions in the Women’s Market globally. This is the first annual publication of this survey and presented here is an aggregate analysis of the data. We will publish additional results in the coming years as banks continue to...

Credit Risk & Scoring

Fintech

Nov 30, 2016

This report by Accion Venture Lab describes the latest innovations in the field of micro, small, and medium enterprise (MSME) finance. In it, Venture Lab explores how innovative, tech-enabled lenders are using niche marketing, digital or mobile platforms, and enterprising partnerships – and often a combination of all three – to make financing...

Alternative Financing

Nov 15, 2016

Crowdfunding can be labeled in many different ways: as “a financial innovation,” “fintech,” “the fastest growing financial industry,” or “the next big thing in financial inclusion.” The term “crowdfunding” typically describes a method of financing whereby small amounts of funds are raised from large numbers of individuals or legal entities, to...

Gender Finance

Oct 28, 2016

This policy brief examines the gender-related constraints faced by women-owned SMEs and provides some policy recommendations to address this issue. Within APEC, four main categories of constraints that female SME owners face to access to markets have been identified. Firstly, it has been harder for female entrepreneurs to identify opportunities to...

Policy & Regulation

Credit Risk & Scoring

Aug 03, 2016

Small and medium-sized enterprises (SMEs) play a crucial role for employment, job creation, investment, innovation and economic growth around the world. They account for about 90% of businesses and more than 50% of employment worldwide, and are therefore crucial for the recovery of the world’s economy. Considering this important role, it is...

Jun 27, 2016

While there are many foundations and drivers to achieving financial inclusion, the potential impact of extending digital financial services through a more widespread acceptance among small retailers is substantial. Traditional retailers in developing economies, the majority of which are micro, small, and medium enterprises, most often do not use...

Jun 23, 2016

In response to the current low growth trap facing many economies, the newly released publication "Financing Growth; SMEs in Global Value Chains" advocates G20 policy consistency for long-term financial stability, investment, and economic growth. It shares perspectives from government, international organizations, business, and academic thought...

Gender Finance

Apr 11, 2016

Over the past nine years, the number of women-owned firms has grown at a rate five times faster than the national average, reaching a post-recession high, according to the 2016 State of Women-Owned Businesses Report, commissioned by American Express OPEN (NYSE:AXP). The sixth annual report, which is based on historical and current U.S. Census...

Sustainable Finance

Apr 04, 2016

Small and medium-sized enterprises (SMEs) account for 99 percent of all enterprises in Myanmar. This study examines opportunities available for SMEs to obtain funding for sustainable consumption and production (SCP) measures, in particular for green innovations, efficiency improvements, and pollution abatement. The study also identifies current...

Credit Risk & Scoring

Mar 23, 2016

The World Federation of Exchanges, which represents more than 200 market infrastructure providers including exchanges and CCP's, today released the results of a study on SME markets. The WFE took input from the World Bank Group's Finance and Markets Global Practice on the paper. It highlights the key role played by exchanges in the real economy by...

Payments

Mar 22, 2016

The Payment Aspects of Financial Inclusion report examines demand- and supply-side factors affecting financial inclusion in the context of payment systems and services, and suggests measures to address these issues. The report has been prepared for the Committee on Payments and Market Infrastructures (CPMI) and the World Bank Group by a task force...

Financial Education

Mar 18, 2016

Does poverty hinder or encourage market creativity? Businesses that offer novel, creative products have greater growth potential than businesses that conform to market norms. Yet the literature offers conflicting views on the relationship between poverty and market creativity. Some research suggests poverty restricts entrepreneurs’ capacity to...

Rural & Agriculture Finance

Mar 07, 2016

Agricultural Value Chain Finance - A Guide for Bankers has been developed in partnership with Bankaool, Mexico, HBL Bank, Pakistan and HDFC Bank, India. It provides: practical, evidence-based guidance to financial institutions engaging in agricultural value chain finance (AVCF) comprehensive picture of agricultural value chains to enable financial...

Sustainable Finance

Feb 22, 2016

This report reflects the results of a research project carried out by SNV during 2011 and 2012 with funding from the Ford Foundation and the Inter-American Development Bank’s Multilateral Investment Fund (IDB-MIF). The aim of the research was to investigate the extent to which inclusive business initiatives can make a substantial contribution to...

Credit Risk & Scoring

Feb 19, 2016

This paper offers a critical survey of the microfinance literature of the past 10 years. It reviews studies on the effectiveness of different microfinance techniques and offers a critical assessment of the impact literature of microfinance. The literature so far suggests moderate but not transformative effects of microcredit, with effects being...

Guarantees

Credit Risk & Scoring

Feb 08, 2016

The financial and economic crisis has brought to the fore small business banking’s key challenge: How can banks master the cost of risk and also accelerate development?

Jan 08, 2016

2015 was a transformational year for women entrepreneurs and their businesses. Women are starting 1,200 new businesses per day – they are inventing products, solving problems, creating jobs and supporting their communities. The impact is undeniable and the growth is unprecedented, but we have a long way to go before reaching parity. Women continue...

Financial Education

Credit Risk & Scoring

Jan 05, 2016

Many banks around the world have been successful by focusing their services around micro, small and medium enterprise (MSME) banking. However, there is a tendency for such banks to focus on the higher end of the MSME market, avoiding the risks and administrative costs that come with serving smaller businesses. Şekerbank in Turkey is an interesting...

Rural & Agriculture Finance

Dec 30, 2015

Agricultural finance is crucial to support the growth of the agricultural sector. Indeed, it is essential for food security, job creation, and overall economic growth. This synthesis report presents a summary of research studies on five key areas of agricultural finance innovation prepared under the G20 Global Partnership for Financial Inclusion (...

Oct 28, 2015

Membership of the SME Finance Forum is open to a broad range of institutions that promote access to finance for small and medium enterprises (SMEs), including banks, non-bank financial institutions, development finance institutions, and fintech companies. To become a member, please complete the membership application form and email it to Hourn Thy...

Guarantees

Sep 10, 2015

The Principles are developed for the purpose of being applied to public CGSs for SMEs. Public CGSs for SMEs are institutions created by the government, which retains de jure or de facto control as defined in relevant home country laws, to provide credit guarantees to lenders to ease access to credit for SMEs operating in its jurisdiction. Target...

Rural & Agriculture Finance

Sep 02, 2015

Providing financing to agriculture is challenging for both male and female farmers, however women face some unique challenges. These challenges relate to the role of women in the household which often restricts their control over assets and constrains their available time for productive activities. Their role in the household is often invisible,...

Aug 10, 2015

According to this detailed study of UK women and entrepreneurship produced for RBS by Aston Business School, women do not have any individual or collective entrepreneurial deficit. Instead, this report finds that it is a combination of challenge and choice. Whilst there is clearly a cultural challenge, women also choose to use entrepreneurship...

Credit Risk & Scoring

May 12, 2015

In the last few years, there has been growing recognition of the importance of small and medium enterprises (SMEs) for job creation and economic development, not just in emerging economies but in developed countries as well. The impact of the financial crisis that began in 2008 highlighted the importance of access to finance for the SME sector as...

Financial Education

Non Financial Services

Credit Risk & Scoring

Oct 14, 2014

This report encourages APEC leaders to increase financing alternatives for SMMEs by exploring innovations within the SMME financing landscape, and reviewing the regulatory framework and environment required to enable these new models to be introduced successfully. APEC governments should provide an enabling environment that can support a diverse...

Gender Finance

Rural & Agriculture Finance

Sep 04, 2014

In this issue brief, the second in Root Capital’s Issue Brief Series, we share our experience of applying a gender lens to our work in smallholder agricultural finance. Through our Women in Agriculture Initiative, we have been able to better understand the areas in which we know we support women (as farmers, agro-processing employees, and leaders...

Gender Finance

Jul 07, 2014

A qualitative study on women’s access to financial services in Mozambique (covering selected provinces in the South, center and Northern regions of the country) found that women have shown great propensity to adhere to financial services, particularly savings. They are more dynamic in finding financial solutions through the use of various...

Policy & Regulation

Payments

Jun 30, 2014

Mobile financial services - often called mobile money - are a high priority for many mobile operators, financial institutions, technology firms, and governments. In regions where financial inclusion is limited, such as sub-Saharan Africa, mobile money promises a lower-cost, more scalable alternative to traditional banking. Yet despite high...

Financial Education

Mar 24, 2014

The World Bank Group promotes small and medium-sized enterprise (SME) growth through both systemic and targeted interventions. A critical challenge is to root the many activities now undertaken in this broad space in a clear understanding of the characteristics and dynamics of SMEs their role in the broader economy; and their actual and potential...

Rural & Agriculture Finance

Jan 30, 2014

Supply chain finance has played an important role in easing liquidity constraints and improving the competitiveness of the grains sector in Mexico—one of the world's largest grain producers. This type of financing increases access to credit for producers, enhances the reliability of supply for buyers, and serves as a risk management mechanism for...

Rural & Agriculture Finance

Jan 28, 2014

Over the past 15 years that Root Capital has been working in smallholder agricultural finance, we’ve found that assessing the social and environmental practices of our clients is way to generate financial benefits as well as impact. Our inaugural issue brief focuses on the emerging business case for financial institutions to conduct due diligence...

Non Financial Services

Jan 20, 2014

In February 2012, the JPMorgan Chase Foundation launched the SME Catalyst for Growth (C4G) programme in South Africa to support the growth of small and medium-sized enterprises (SME) in collaboration with three core partner: Dalberg Global Development Advisors (Dalberg), Aurik and Raizcorp. Through this partnership, the JPMorgan Chase Foundation...

Alternative Financing

Nov 25, 2013

Shivani Siroya founded InVenture in April 2011 as a crowd-sourcing platform for micro, small and medium enterprise (MSME) investment. Her broader objective was to promote financial inclusion across the developing world. InVenture provided exible, equity-like capital to individuals unable to access formal bank loans or investment capital. Through...

Gender Finance

Nov 18, 2013

This report presents general results of the sixth survey with 100 banks located in 21 countries in Latin America and the Caribbean. It also includes a detailed analysis of the responses according to the size and location of the entities, as well as other behaviors and aspects of the SME segment. The survey was a collaboration between the...

Credit Risk & Scoring

Nov 18, 2013

An annual survey of banks in Latin America and the Caribbean regarding the small and medium enterprise (SME) sector shows overwhelming interest in SMEs as banking clients. Ninety-six percent of the 100 banks interviewed in 21 countries in Latin America and the Caribbean consider SMEs to be a strategic part of their business, and 92% have a...

Equity

Nov 14, 2013

Capital markets promote economic development and growth by facilitating and diversifying firms’ access to finance. In order to do this they rely on institutions, including sound financial reporting and assurance, and these in turn depend on the accounting profession. This discussion paper considers how these relationships work and how policymakers...

Policy & Regulation

Nov 14, 2013

The provisions of Basel III, the global framework governing the regulation of bank capital, liquidity and leverage, will, for the coming years, determine the supply and cost of capital to businesses globally. The financial crisis presented policymakers with a choice between promoting business growth and safeguarding financial stability. This paper...

Credit Risk & Scoring

Nov 11, 2013

The important development contributions that IFIs make when engaging with the private sector in developing economies are often not clear or adequately communicated to stakeholders and the public. It is the aim of this report to help bridge that gap—to increase the information and understanding about both the value of the private sector in...

Alternative Financing

Nov 06, 2013

This study provides a summary of crowdfunding initiatives that support developing country entrepreneurs. The purpose of the paper is to present an overview of the crowdfunding industry to help the Department for International Development (DFID) of the UK Government assess the need and value of supporting such initiatives – particularly for climate...

Alternative Financing

Nov 06, 2013