Blog

Member Survey Results on the Impact of COVID-19

During crises like COVID-19 pandemic, sharing experiences and learning is vitally important. The SME Finance Forum team sent out a rapid survey to our members this week to take their pulses on how their institutions and their SME clients are faring so far (Click here to see what we asked). We had 45 respondents from 32 different countries: 24 banks/FIs, 12 Fintechs, five Development Banks, and four others (associations).

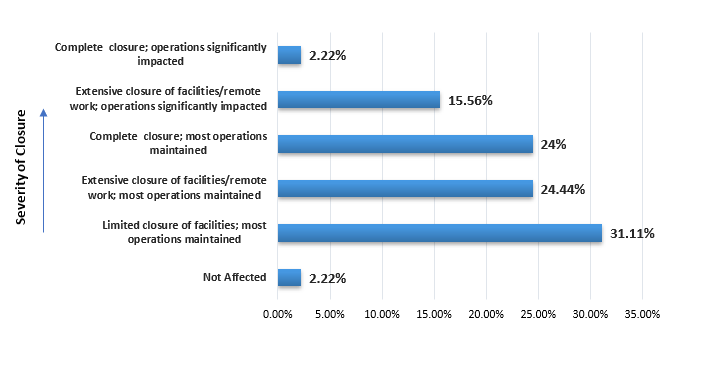

Although many of our members are from countries where the health situation is not impacted yet, experiences and attitudes are already pretty grim. The good news is that almost 80 percent report most or all necessary operations are maintained, though nearly two-thirds have complete or extensive closures of their physical facilities. Only 18 percent of our members reported a significant impact on their operations.

Although lockdowns and other social disruption are new in many of our members’ markets, more than three quarters reported a decline in sales, and 20 percent spoke of a loss of customers. Almost half reported declines in inflows and collections. One-quarter of the survey respondents are concerned about wholesale funding declines (presumably our non-bank lenders), and roughly 16 percent are reporting drops in deposits (likely our regulated deposit-taking banks and MFIs). Another quarter of our members report a gain of customers so far.

Perhaps most alarmingly, almost three-quarters of respondents predict that more than 40 percent of their SME clients will be in financial distress within the next three months. This, spread across all regions of the world, would have a much more extensive impact than occurred during the last financial crisis.

Most members’ governments already have announced response measures, and the good news is that over 70 percent of members felt these government COVID19 responses would help their SME clients. It may be telling, at this stage, that only 40 percent of our members felt that governments’ responses would help them – with another 30 percent fearing that these responses would hurt their businesses!

Of our 45 member respondents, 32 are involved in lending. Over 70 percent of these reported at least a slight negative impact on their portfolio. Some 35 percent reported a significant negative impact on the portfolio.

Over 60 percent of lenders have tightened their credit criteria, with over half discontinuing new lending entirely. Only 37 percent reported that they continue lending to both existing and new customers.

Looking to the future, over 60 percent of respondents said that they expect to have less revenue next month than this month. Over 55 percent say they expect a decline in customers in the month to come, and 55 percent of our lenders predict a decrease in new lending.

While it was extremely useful to get this early feedback from our members, it indicates that we should be prepared for a rough road ahead.